Cody’s Cafe

Feb 28 from 10am to 2pm PST

Overview

Join us and learn real estate investing with fantastic companies. Network with experienced real estate investors and professionals.

Discover the Latest Real Estate Insight, News and Investing Strategies at Realty411’s Meetup in Santa Barbara.

Network with sophisticated real estate investors from locally and visiting guests from across the state and the nation at this networking and educational meetup.

This is the place to learn real estate investing with experienced investors and real estate professionals who have personally invested both locally and throughout the United States, some even internationally.

Guests who join us will gain specialized knowledge in diverse real estate investing topics and subjects at each event. Known as the American Riviera, Santa Barbara offers a fantastic weekend escape and past events in Santa Barbara have been attended by investors and companies from throughout the country.

Hosted by Dan Ringwald, a local multiple business owner and director of the Santa Barbara Real Estate Investors Association, Realty411’s Santa Barbara MeetUp offers the perfect opportunity to network.

If you are serious about personal finance, join us to learn about top markets, success strategies, insider tips, and so much more. Join us for breakfast or brunch. Please note, for this event, each guest will be paying for their own meal.

article continues after advertisement

Let’s unite to network and learn in the Central Coast of California for one very special day. Some of the topics discusses on this day include:

- Learn about the benefits of a Delware Statutory Trust

- Discover the benfits to owning land in California

- Real estate and AI – Where it is and where it’s going

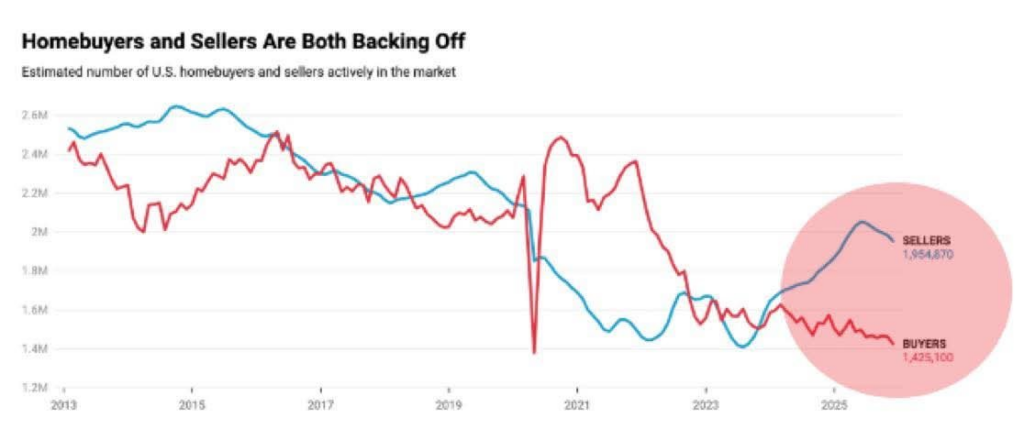

- Updates on the local and national real estate markets

- Meet and connect with active investors in the area

Some of the Awesome Educators Joining Us Include * :

Dan Ringwald – SB REIA

Linda Pliagas – Realty411.com

Trevor Flor, MBA, MSRE – Aimpoint Investments

Paul Wilkins, Approved Inheritance Cash

PLUS, MORE TO BE ANNOUNCED!

*Please note our speaker schedule may change due to unforeseen circumstances.

Grasp this opportunity to connect and learn from top real estate investors.

Pencil in this date now and join us in-person to gain specialized insight and knowledge. The information shared on this special day could catapult your portfolio to new levels. Discover our print magazines, VIP perks, plus connect with industry resources.

This real estate investing MeetUp has something for everyone regardless of their experience level in real estate. Join this memorable day and receive knowledge for a lifetime. This is Your Chance to meet TOP Leaders in REI, Local & National Experts:

- Learn from Leaders & Industry Pros

- Meet Local PLUS Out-of-Area Investors

- NON-Stop Tips for Real Estate Success

- Bring Lots of Business Cards

This event is produced and hosted by Realty411.com. Since 2007, we have dedicated our time and resources to help expand real estate investing knowledge and education to the masses by producing magazines, virtual conferences, webinars, podcasts, and live events. We currently produce six real-estate websites, with Realty411.com capturing nearly 1 million views so far.

INVEST YOUR TIME HERE FOR ONE SPECIAL DAY OF NETWORKING & MOTIVATION – TAKE YOUR REI KNOWLEDGE TO A WHOLE NEW LEVEL.

Learn from educators and new topics — What can expect?

- Receive the latest REI knowledge from active investors

- We will discuss the latest technology trends and info

- Meet other investors with common goals and mindsets

- Develop relationships with leaders in the industry

- Share your opportunities with potential clients

- Realty411’s publisher has owned rentals for many decades

- We host in-person events to meet our readers and to spread knowledge

- We have reached tens of thousands of investors in 14 states so far!

Our mission is simple: To provide realty knowledge and resources so that everyone can learn about the benefits of investing.

OTHER SPECIAL BONUS PERKS INCLUDE:

- Influential Real Estate People & Business Owners Are Attending

- Learn How to Leverage and Meet with Private Capital Lenders

- Find Potential Partners, New Friends, Build Your Circle of Influence

- Your Net Worth = Your Network — Don’t miss this event

- Mingle with Leaders & Industry Professionals Here

Please bring LOTS OF BUSINESS CARDS, it’s time to Network! Learn more about our magazines and our company sponsors and resources, visit Realy411.com

article continues after advertisement

Hosted by Realty411.com — Our company’s mission is to inspire as many people as possible so they too can positively change their lives by carefully investing in real property. So far, Realty411.com has reached nearly 1 million visitors — investors all across the nation and world.

CELEBRATE OUR NEW MAGAZINE AND MEET THE TEAM

For any questions, please contact Realty411.com at 805.693.1497 or 310.994.1962 – email [email protected], thank you.

WOULD YOU LIKE TO SPEAK IN FRONT OF OUR LOYAL INVESTORS?

PLEASE REACH US FOR DETAILS AT: 805.693.1497 OR 310.994.1962.

ABOUT US:

REALTY411 HAS HOSTED CLOSE TO 24,000 GUESTS AT EVENTS ACROSS THE NATION, ACCORDING TO EVENTBRITE STATISTICS. BE SURE TO REACH US TO BE A PART OF THIS WONDERFUL EVENT.