Network with sophisticated investors from across the country in beautiful Southern California. Join us for Realty411’s “Real Estate Summit – Thrive in 2026!”

To celebrate the beginning of a new year and the publishing of the latest print edition of REI Wealth Magazine #65, Realty411 is hosting a “Real Estate Summit – Thrive in 2026!”

This one-day impactful conference is designed to help guests achieve maximum success in real estate investing and beyond. Join us on Saturday, March 28th, starting at 9 AM. DOORS OPEN AT 8:30 AM.

Be sure to attend this one-day event featuring timely REI insight, top educators, and active investors from locally and out of state.

Realty411’s “Real Estate Summit – Thrive in 2026!” is being held at Four Points by Sheraton Los Angeles Westside, located at 5990 Green Valley Circle, Culver City, California, 90230. The venue is located near LAX, convenient for guests visiting from out of state.

DOWNLOAD OUR EXPO PUBLICATION!

Some of the topics discussed will include:

- Learn How to Exit a Corporate Job and Close $100M+ in Real Estate

- Discover Opportunities in Commercial Development in Southern California

- The Latest News on Property Financing With an Experienced Broker & MLO

- 5-Step Business Funding to Get $350,000 in Bank Credit Lines in the next 120 Days

- What Loan Officers Need to Know about Non QM Loan

- Discover Off Market Deals and Meet Turnkey Providers

- Learn About the Latest Technology and its Use in Real Estate

- Meet Founders of Real Estate Companies and Learn Directly

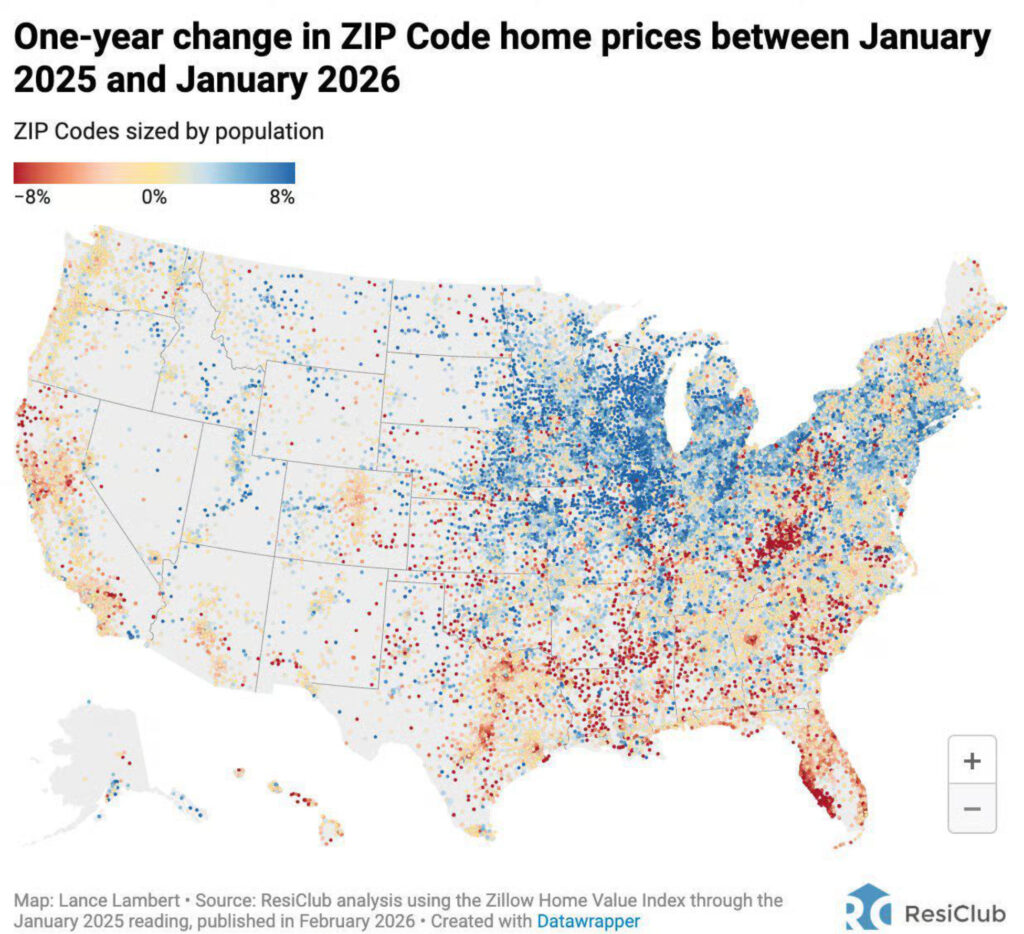

- Gain Insight on Real Estate News, Trends and Strategies from Experienced Investors and Real Estate Professionals

This is the place to learn real estate investing with experienced investors and real estate professionals who have personally invested both locally and throughout the United States.

Guests who join us will gain specialized knowledge and learning in diverse real estate investing topics and subjects. Our featured educators have decades of personal experience in real estate investing and will answer your complex questions.

If you are serious about personal finance, join us to learn about top markets, success strategies, insider tips, and so much more. The latest edition of Realty411 magazine will be available, as well as past editions, too.

SELF PARKING FOR THIS EVENT IS ONLY $5 – Plus, there is plenty of parking with overflow parking available at the mall across the street or parking lot next door. As a bonus, all guests will receive the latest publication!

DOWNLOAD OUR EVENT PROGRAM – LEARN ABOUT OUR SPEAKERS:

https://joom.ag/dNvd or CLICK HERE.