Attribution: Tim Sedgwick, Vice President of Operations, Real Property Management, a Neighborly company

2026 is here, bringing great news about the rental housing market conditions. While economic forecasts will always evolve alongside interest rates, inflation, and employment trends, several consistent indicators give us confidence in where the market is heading. These expectations are grounded in national housing data, decades of operational experience, and real time insights from a nationwide franchise network managing both single family and multifamily homes.

Demand for rental housing remains strong, affordability pressures persist, and professional management is becoming a stabilizing force for both residents and investors in an increasingly complex environment.

article continues after advertisement

Single Family Rentals Remain a Cornerstone of Demand

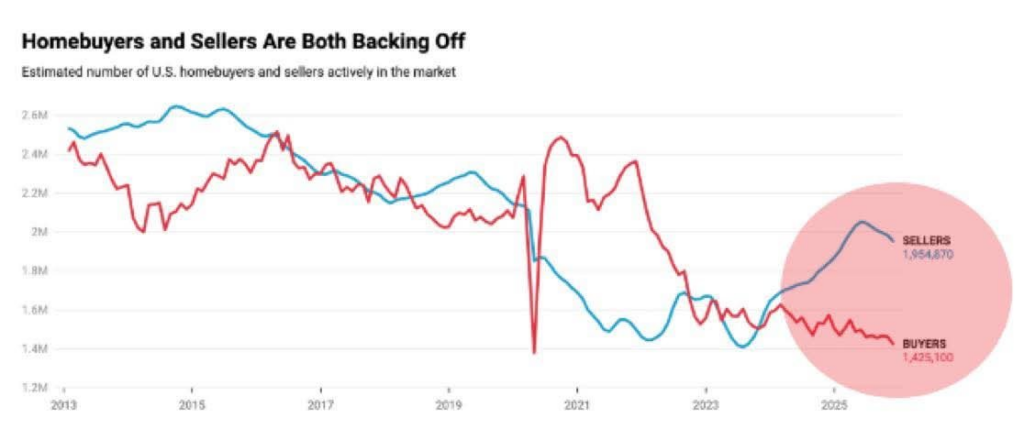

Single family rentals will continue to play a central role in the housing market through 2026. Many households remain priced out of homeownership, particularly first-time buyers facing higher home prices, insurance costs, and down payment requirements.

At the same time, millions of existing homeowners are effectively locked into historically low mortgage rates and are choosing to stay put rather than sell. This limit is available for sale inventory and further pushes households toward renting. Investors are also recognizing single family rentals as recession resistant assets that provide long term stability rather than short term speculation.

As a result, occupancy rates are expected to remain strong, with turnover staying below pre-pandemic norms. Rent growth, however, is settling into healthier territory. The rapid spikes seen in 2021 and 2022 are not expected to return. Instead, 2026 is likely to bring moderate national rent growth in the range of two to four percent, with Sunbelt markets slightly outperforming due to continued population growth and job migration. This balance between supply and demand supports a more sustainable rental environment for residents and owners alike.

Affordability Pressures Will Shape Housing Choices

While inflation has cooled overall, wage growth continues to lag the cost of living for many households. This reality will keep affordability front and center throughout 2026. More renters are expected to choose smaller homes, shared living arrangements, or multigenerational housing as they look for ways to manage monthly expenses.

These pressures are also driving increased regulatory attention. We expect ongoing scrutiny around fees, screening practices, and transparency, as well as expanded conversations around rent control in high-cost states. Affordability will remain a dominant public narrative, especially as maintenance and operating costs continue to rise.

Even with inflation slowing, maintenance expenses are still increasing at an annual rate of approximately three to six percent, driven by labor shortages and material costs. This environment highlights the value of preventive maintenance, strong vendor partnerships, and operational consistency. Professional management companies are better positioned to absorb these pressures than do it yourself landlords, who often struggle to keep pace with rising costs and compliance requirements.

Investors Are Returning with a Focus on Risk Reduction

As interest rates normalize, we expect small and mid-sized investors to reenter the market in greater numbers. However, their mindset has shifted. Rather than prioritizing rapid expansion, investors are focused on reducing operational risk and protecting long-term returns.

Professional property management, regulatory compliance support, and predictable maintenance solutions are now top priorities. Many investors who attempted self-management in recent years are returning to professional management after encountering regulatory complexity, rising maintenance costs, and increased resident expectations. In this environment, professional management is no longer viewed as optional but as essential infrastructure. Investors should be looking for professional property management that helps them understand the total return of their investment properties to optimize their returns in 2026.

Technology and AI Will Redefine Operations and Expectations

Technology adoption is accelerating across the rental housing industry, and 2026 will be a defining year for automation and artificial intelligence. AI enabled leasing tools, automated maintenance triage, inspections, and workflow systems are becoming standard rather than experimental.

Residents increasingly expect fast communication, transparency, and consistency, pushing operators toward more modern platforms. Resident benefit packages, which bundle services such as maintenance coordination, insurance options, and digital communication tools, are also gaining traction to improve the resident experience while creating operational efficiency.

These tools are not about replacing people. They are about allowing property managers to focus on higher value service, faster response times, and proactive care of the homes they manage.

Legislative Changes Will Elevate Standards

States including California, Colorado, New York, New Jersey, Virginia, and Minnesota are tightening habitability requirements and enforcement standards. These changes are elevating public conversations around resident safety, response time expectations, preventive maintenance, and operational transparency.

For professional operators, this shift reinforces the importance of systems, documentation, and consistent execution. For renters, it underscores the value of working with established management companies that understand compliance and prioritize safety and service.

What This Means for Renters in 2026

Renters who search strategically and understand how the market works experience far less stress and better outcomes.

Renters should begin their search online by identifying non-negotiables rather than aesthetics. Monthly rent including known fees, location radius, lease length options, pet policies, parking availability, and laundry access should be established first. Preferences such as finishes and amenities can come later.

Transparency is critical. Listings with few photos, vague descriptions, missing fee details, or pressure to apply before touring should raise concern. Professional management is often reflected in clear communication, complete disclosures, and consistency across listing platforms.

When viewing staged properties, renters should focus on layout, storage, lighting, room dimensions, and how the space will function day to day. Staging can be helpful, but it can also distract from practical limitations.

Functional amenities tend to matter most. In home laundry, reliable parking, responsive maintenance, energy efficient systems, and secure package delivery consistently rank higher than novelty features. Renters should evaluate total cost of living, factoring in transportation, utilities, parking, and maintenance responsiveness rather than focusing solely on base rent.

Guidance for First Time Renters

First time renters should understand the full cost of renting beyond monthly rent. Application fees, deposits, utilities, parking, renters’ insurance, and pet related costs add up quickly. Preparing documentation in advance and understanding screening criteria can make a significant difference in competitive markets.

Reading the lease carefully is essential. Maintenance procedures, emergency response expectations, renewal terms, and early termination clauses should never be overlooked. Completing a detailed move in condition report with photos and videos protects renters at move out and prevents disputes.

article continues after advertisement

Looking Ahead

The rental market is becoming more balanced, more regulated, and more professionalized. Residents want safety and service. Investors want predictability. Professional management delivers both.

For media conversations and pitch planning, key themes will include rental affordability, investor strategy, resident service expectations, maintenance innovation, regulatory guidance, and the role of professional management as a stabilizing force in a shifting market. Those who understand these dynamics will be best positioned to lead the conversation and succeed in the years ahead.

SOURCE: Mike Steward, VP of Real Estate Sales for Real Property Management (RPM). Mike has more than 18 years of business ownership, including working in real estate. He is available to dive into the 2026 rental market shifts he is seeing, including:

- How economic pressures are pushing demand for short-term leases

- The growing impact of Gen Z and retiree renters on housing demand.

- Why remote and hybrid workers will continue to influence rental design and location choices

- The role of AI and smart tech in streamlining property management

- Why tech-enabled rentals will see stronger occupancy and retention rates

- Top cities to invest in vacation rentals