By Rick Tobin

As we kick off the new year here in 2026, many of us wonder if this year will be stronger or weaker and whether or not this will be more of a buyer’s market than a seller’s market. Either way, there will be success if we focus more on the potential solutions and opportunities more so than the temporary obstacles standing in our way.

Prices for goods, services, or assets like homes can be simplified by way of the Law of Supply and Demand as I learned in past Economics courses that I took as a student and later wrote as an author.

When supply exceeds demand, prices tend to value. Conversely, increasing demand and decreasing supply usually cause prices to rise.

Let’s review some factors that may cause home prices to be flat or drop here in 2026:

article continues after advertisement

Concerning Housing and Economic Trends

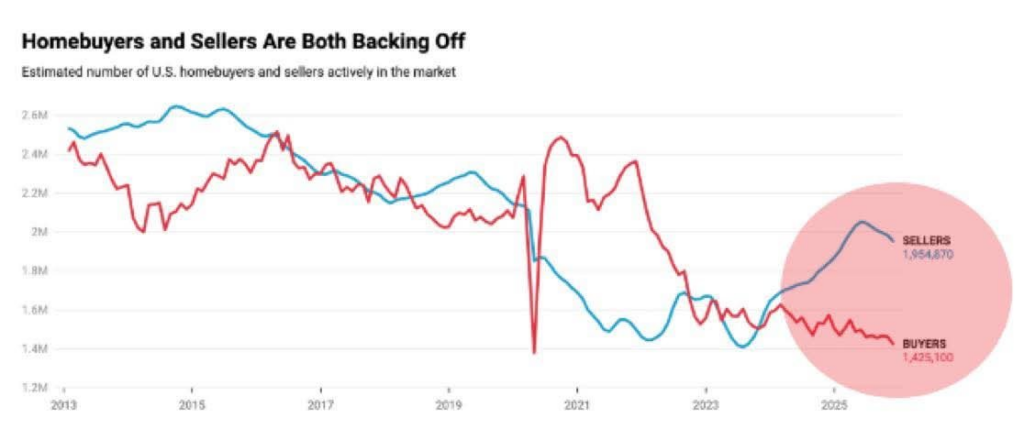

1. As of Q4 2025, U.S. home sellers or listed homes outnumbered buyers by 530,000, which was an all-time record high. This is partly due to home prices being at or near all-time record highs in most U.S. regions, while making housing costs more unaffordable.

For example, the U.S. home price-to-median household income ratio is close to 7.0x, near an all-time high. For comparison purposes, the 2006 housing bubble price peak was 6.8x.

The difference between the median U.S. home price ($426,800) and household income ($83,700) reached $343,100 in Q4 2025, which was the largest gap in history as per Barchart.

2. U.S. homebuyer demand is near the lowest level on record primarily due to how unaffordable payments and home prices are across the nation. The typical homebuyer needs to pay 39% of their gross income in order to afford to purchase a home. Sales demand plummeted to the lowest level in 40 years (only 4.7% of occupied homes sold in 2025, which was the lowest number since 1982), as per Reventure.

Please note that this is gross income (before taxes). In many states like California, the combination of state and federal taxes brings this monthly income much lower, so many buyers are paying upwards of 50% to 65% of their net monthly income to buy or lease a home.

3. We have an inverted housing market in so many different ways, especially as it relates to age. There are more home buyers over age 70 than under 35 in today’s upside-down housing market. The average U.S. home seller age in 2025 64, while the average Realtor age is 60 as per NAR. The average first-time home buyer in California last year was 49.

4. The published national home listing inventory supply is rising, while still being almost half of peak highs in 2007 when it reached near 4,000,000. Yet, this seemingly “good news” is offset by the possible “bad news” that’s included next as #4.

5. The distressed “shadow inventory” is much larger than the published national home listing supply. The national home listing inventory and published foreclosure date is nowhere close to being accurate and is artificially suppressed, partly due to the millions of distressed forbearance deal (FHA and VA loans, especially) situations where many homeowners haven’t made a single mortgage payment dating back as far as October 2020 when many of the Covid-19 forbearance plans started. As these distressed properties later become listings or go to foreclosure, the home listing supply should increase.

6. Average new U.S. home prices are now priced below older existing homes, which is something that rarely happens because most buyers are willing to pay a price premium for a new home with all of the fancy new appliances and other gadgets. Builders are so inspired to unload their unsold inventory that they’re offering massive credits to buyers to buy down their mortgage rates and pay for their closing costs.

Let’s take a closer look at data that was originally compiled by ResiClub as it relates to how unsold new home inventory increased between July 2016 and July 2025:

The unsold new home number for July 2025 was the highest number since July 2009 (126,000), which was when the housing market was near the previous bottom during the depths of the Great Recession.

7. The most important word in the “single-family home” description is family. As the family unit continues to rapidly decline, it will directly impact future home value trends.

Here’s some other family trends that I’ve shared in past articles such as The Interplay of Medical, Insurance, and Housing Financial Burdens:

* The overall divorce rate in Orange County, CA is 72%; it’s 60% in California; and 50%+ nationwide.

* 41% of first marriages end in divorce, 60% of second marriages end in divorce, and 73% of third marriages end in divorce.

* The average length of a marriage in the U.S. that ends in divorce is 8 years from start to finish.

* Since 1990, divorce rates for people over 50 have doubled; they’ve tripled for people over 65.

* The U.S. now has the highest percentage of single-person households in the world and lowest marriage rates ever.

* U.S. fertility rates are the lowest ever, as fewer babies are born.

* USA is #1 for highest teen pregnancy rate in the industrialized world.

* Approximately 50% of children are born to unmarried women under 30 here in the USA.

8. The purchasing power of $1 fell to about 7 cents over the past 50 years, so most of the dollar’s decline in value has taken place during this 50-year time period that followed the removal of the dollar from the gold standard during the 1971-1973 years as I shared in the Asset Prices Surge Amidst Dollar Devaluation Trends article.

Because real estate is an exceptional hedge against inflation as home values tend to rise at least more than double the annual published inflation rates, this has actually been a positive for homeownership and a huge negative for other products and services.

9. The median household family income is not keeping up with rising costs for things like housing, cars, education and healthcare. This is partly due to rising divorce and unemployment rates and the ongoing collapsing purchasing power of the dollar.

For example, let’s compare income and expense data dating back to 1970, which was just one year before President Nixon removed our dollar from the gold standard and inflation skyrocketed, while our purchasing power imploded over the past 50+ years.

The median U.S. household income increased from $10,000 in 1970 up to $106,000 in 2025, which was an increase of 10x (or 10 times). Please note that this is household income, which may include multiple income sources from the adult occupants.

While the rising household income was a positive, the negatives were as follows during that same 1970 to 2025 timespan:

● Median U.S. home prices rose from $25,000 to $445,000 (double this amount in California), which was an increase of 17x.

● Median car prices jumped from $3,600 to almost $50,000, which was an increase of 14x.

● The median college price rose from $2,900 per year to $45,000, an increase of 16x.

● The average costs of healthcare per person skyrocketed from $350 to $14,600 per year, which was a massive increase of 42x.

Source: The Finance Newsletter

Positive Housing and Economic Trends

1. More than 40% of owner-occupied single-family homes are now owned free-and-clear with no mortgage debt. Homeowners with no debt are much more likely to not sell at hefty future discounted prices because many of these homeowners, or their heirs, can just sit back and wait for the housing market to strengthen again.

2. Large billion and trillion-dollar corporations like BlackRock, Vanguard (largest BlackRock shareholder), Blackstone (a BlackRock spinoff and the world’s largest commercial real estate owner) continue to purchase both residential and commercial real estate.

3. An increasing number of foreign buyers from places like China, Japan, and India keep purchasing U.S. real estate. As per this linked video from the Econofin team, there’s potentially a $56 billion dollar cash buyer invasion from foreign investors (a +44% foreign investor percentage surge) that is keeping real estate demand steady in many U.S. regions.

4. The ongoing “shadow inventory” of distressed residential and commercial real estate properties and mortgages, which includes the estimated all-time record high 12%+ of all FHA loans that are currently delinquent and trillions of dollars’ worth of ballooning commercial mortgages, are continued to be delayed via “extend and pretend” strategies or silently being sold off to huge investment funds. As a result, these strategies are artificially suppressing the residential and commercial real estate inventories that may keep values at least flat instead of rapidly declining.

5. Both short-term and long-term rates are expected to keep falling in 2026. Lower rates make home purchases more affordable for an increasing number of buyers. Mark Zandi, the well-known Moody’s Analytics economist, forecasts at least three rate cuts in 2026 as shared in this recent CNBC article.

6. Existing-home sales are projected to rise by around 14% in 2026, according to the National Association of Realtors (NAR) Chief Economist Lawrence Yun, partly due to lower rates and increasing home listings for sale.

7. The dollar is more likely to keep falling in 2026 which, in turn, should push asset values higher like we saw in 2025 with these asset gains:

● S&P 500: +16.65%

● Nasdaq 100: +20.14%

● Dow Jones: +13.40%

● Russell 2000: +11.31%

● Gold: +61.48%

● Silver: +139.21%

Source: The Market Hustle

article continues after advertisement

Back in Rome in 284 AD, Spain in 1607, the Netherlands in 1815, and Great Britain in 1931, each region saw the price of gold and silver triple just a few years before their economic and currency resets. We’ve seen the same thing happen here with skyrocketing gold and silver prices in the U.S. in recent times, interestingly.

8. Pending home sales jumped +3.3% month-over-month in November 2025, as per the NAR. This was the 4th-consecutive monthly gain, which matched the longest streak seen during the 2020 pandemic declaration dates. The West posted the largest pending home sales increase, which is very positive for our home state region of California and other nearby states.

9. There were almost 40 million more people who lived in the U.S. in 2025 than back in 2007. Because there’s still a shortage of affordable housing to rent or buy, the demand for properties should remain solid.

Be Proactive, Not Reactive

Whether you think that the housing market will boom, bust, or be flat in 2026 for your target housing region, there will still be opportunities.

For buyers, you may have much less competition to write up discounted offers that may be more likely to be accepted by a motivated seller with a property listing that is sluggish at 6 months DOM (Days on Market) or longer. It’s better to be the only buyer prospect than having to compete with 80+ other buyers or investors willing to pay prices well above the list price.

If both home values and rates drop significantly in 2026, it may allow you the option to buy your very first home or rental property. If so, this is positive news for you to build up your future net worth by being brave enough to purchase in today’s hectic world.

Please research on almost a daily basis to stay on top of housing market trends. In any type of housing market and economic cycle, there are fortunes waiting to be created for those people willing to take action instead of just being fearfully reactive and/or inactive.

The more you learn, the more likely that you will survive and thrive in 2026 and beyond.

Rick Tobin has worked in the real estate, financial, investment, and writing fields for the past 30+ years. He’s held eight (8) different real estate, securities, and mortgage brokerage licenses to date and is a graduate of the University of Southern California.

Rick provides creative residential and commercial mortgage solutions for clients across the nation. He’s also written college textbooks and real estate licensing courses in most states for the two largest real estate publishers in the nation; the oldest real estate school in California; and the first online real estate school in California.

Please visit his website at Realloans.com for financing options, join his investment group at So-Cal Real Estate Investors, and follow his new So-Cal Real Estate TV channel for more details.

Rick Tobin

Realloans (Real Estate Loans)

https://realloans.com/

Phone or Text: (760) 485 – 2422

NMLS 1934868

Equal Housing Opportunity / Equal Housing Lender

To quickly apply online: Loan Application

For our real estate course: Learn Real Estate

Please follow our new real estate channel (watch on television, computers, and phones): So-Cal Real Estate TV

Our Facebook business pages: Realloans, Inside Los Angeles, Inside Pacific Palisades, Inside Long Beach, Inside Huntington Beach, Inside Orange County, Inside La Jolla, Inside San Diego, Inside Lake Elsinore, Inside Temecula Valley, Inside Coachella Valley, and So-Cal Real Estate Investors.

Here are some of my articles: The Fall of 2025 and Rise of New Opportunities, The Intersection of Declining Home Sales and Creative Marketing, Are Lower Rates on the Horizon?, Weather Extremes, Homes, and Insurance Risks, The California Gold Rush Boom, and Are You Focused on Commercial Real Estate?

Please join my So-Cal Real Estate Investors group that meets at Canyon Lake Golf & Country Club, Shoreline Yacht Club in Long Beach, and online: So-Cal Real Estate Investors.