By Rick Tobin

The purchasing power of the dollar continues to rapidly decline, sadly. This weakening dollar trend hasn’t just happened in recent years. Rather, it’s been going on since the formation of the Federal Reserve back in 1913. One dollar in 1913 now has the equivalent purchasing power of about 2 cents today.

Yet, the purchasing power has rapidly decreased at a seemingly accelerated pace since 2020 when the worldwide pandemic declaration began.

As per a home unaffordability study shared by Redfin and Visual Capitalist on April 4, 2024, an “unaffordable” home is defined as a new listing with a monthly mortgage payment that is no more than 30% of the median monthly income in its county.

article continues after advertisement

Here are the findings from this unaffordability report:

- Only 16% of U.S. homes for sale were affordable in 2023, which was an all-time record low.

- By comparison in 2021, 39% of listed properties were considered affordable.

- With just 0.3% of home listings deemed affordable, Los Angeles has the lowest share of affordable listings in America.

- By contrast, Detroit had the highest share of affordable listings with over 51% of homes.

Let’s take a look at how the unaffordable housing numbers have rapidly fallen over the past 10 years:

2023 16%

2022 21%

2021 39%

2020 45%

2019 40%

2018 37%

2017 42%

2016 45%

2015 45%

2014 46%

2013 50%

Source: Redfin and Virtual Capitalist

The Top 20 Most Unaffordable Cities

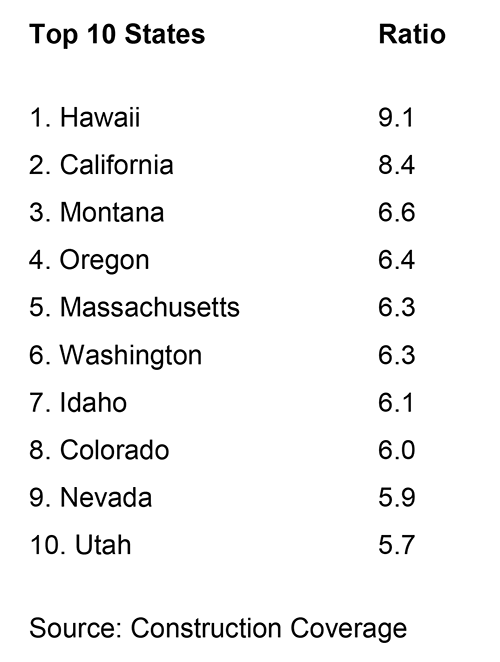

Seventeen of the top 20 most unaffordable U.S. cities to buy a home are located in either the counties of Los Angeles, Orange, or San Diego in Southern California. The other three cities are in Northern California. This is a national study created by the real estate tracking agency Construction Coverage, not just for California.

This data report compiled by Construction Coverage took a closer look at cities of all sizes, while focusing on the ratio of home prices to household income as the core basis for determining how affordable a region is these days.

The Top 3 most unaffordable cities in this study were as follows:

1. Newport Beach, CA: Median home price of $3.23 million; median household income of $127,353; and a home price-to-household income ratio of 25.4.

2. Palo Alto, CA: Median home price of $3.41 million; median household income of $179,707; and a home price-to-household income ratio of 19.

3. Glendale, CA: Median home price of $1.17 million; median household income of $77,483; and a home price-to-household income ratio of 15.2.

There are many regions across the nation with median home prices much higher than these Top 3 unaffordable housing regions. However, those regions generally have much higher household income to make the home price-to-household income much lower.

The California cities in the top 20 of the report are:

1. Newport Beach

2. Palo Alto

3. Glendale

4. Los Angeles

5. El Monte

6. Costa Mesa

7. El Cajon

8. Inglewood

9. Hawthorne

10. Sunnyvale

11. Irvine

12. Huntington Beach

13. Torrance

14. Garden Grove

15. San Jose

16. Anaheim

17. Long Beach

18. East Los Angeles

19. Carlsbad

20. Tustin

article continues after advertisement

States With the Highest Home Price-to-Income Ratios

Toughest Regions to Save Money

The national personal savings rate has dropped from record highs of over 20% in 2020 and 2021 to 3.8% as of January 2024, according to Forbes. Many Americans these days couldn’t come up with $400 in cash for an unexpected emergency, partly due to rising grocery, gas, utilities, housing (own or rent), clothing, restaurant, entertainment costs, and how high or not the state income taxes are there.

Let’s focus on how high certain foods have risen since 2019 to better understand why things seem so much more unaffordable these days:

1. Cocoa: +345%

2. Orange juice: +260%

3. Olive oil: +219%

4. Sugar: +120%

5. Fruit snacks: +77%

6. Cooking oil: +54%

7. Chocolate bars: +52%

8. Apple sauce: + +51%

9. Beef: +51%

10. Mayonnaise: +50%

Source: The Kobeissi Letter

The Riverside-San Bernardino-Ontario metropolitan area is ranked as the #1 most challenging place in America to save money with the Los Angeles-Long-Anaheim metropolitan region ranking second.

The list of America’s hardest metropolitan regions areas to save money in is listed below:

1. Riverside-San Bernardino-Ontario

2. Los Angeles-Long Beach-Anaheim

3. Miami-Fort Lauderdale-Pompano Beach, FL

4. New York-Newark-Jersey City, NY-NJ-PA

5. Atlanta-Sandy Springs-Alpharetta, GA

Sources: Forbes Advisor and KTLA

The top ten most difficult states to save money in can be viewed below:

1. California

2. Hawaii

3. Nevada

4. Oregon

5. Maryland

6. Florida

7. New York

8. South Carolina

9. Colorado

10. Louisiana

Source: Forbes Advisor and KTLA

Rental housing changes: According to data shared by Zillow and NerdWallet, the average U.S. rent was $1,958 in January 2024. This is +29.4% more expensive than before the pandemic declaration in March 2020.

Rising Taxation Risks

Our federal government debt surpassed $34 trillion earlier this year. It’s now growing at a pace of an additional $1 trillion every 90 days, which is an annual new debt pace of $4 trillion per year. For comparison purposes, it took 10 years for the federal debt to increase by $2 trillion between 1980 and 1990.

The White House is seeking to raise another $5 trillion in tax revenues starting next year in 2025 to help offset the increasing size of our budget deficits. For real estate investors, you and your tax advisors should stay focused on these proposals that may more than double the capital gains rate and possibly eliminate the 1031 tax-deferred exchange option, which helps to defer capital gains taxes over a much longer period of time.

If this 2025 budget proposal is enacted, California residents will be looking at upwards of a 59% federal-state capital gains income tax rate starting in 2025. It also may make significant negative changes to the “death tax” for heirs. Don’t be surprised if Americans start selling assets here in 2024 on a larger scale to avoid these much higher capital gains taxes next year.

Additionally, the White House’s 2025 budget proposal includes the creation of a minimum tax equal to 25% of an individual’s taxable income and unrealized capital gains for assets that weren’t even sold for certain higher income people, as per multiple sources including Quoth The Raven.

The combination of increasing all types of taxes (state, federal, capital gains, and possible unrealized tax gains) plus the potential elimination of the 1031 tax-deferred exchange for rental properties will hurt real estate values at some point.

All-Time Record Credit Card

Credit card and overall consumer debt are at all-time record highs along with the total rates and fees (APRs). Credit card defaults are now at the highest level ever or at least since 2012, when the Fed started tracking this data.

Average APRs are fluctuating between 27% and 33% these days for many consumers. It wasn’t that long ago when credit card APRs were closer to 12% about 10 years ago or so.

All stages of credit card delinquency (30, 60, and 90+ days) rose during the fourth quarter of 2023, according to data shared by the Federal Reserve Bank of Philadelphia.

Freddie Mac Bailouts for 2nds

Freddie Mac may soon start purchasing funded home equity lines of credit (HELOCs) in the secondary market, as per multiple sources including HousingWire.

A new multi-trillion dollar stimulus package of up to $2 trillion is being prepared, by way of the government-backed Freddie Mac entity, so that it’s easier for banks and mortgage companies to offer 2nd loans, which will then be quickly sold off to Freddie Mac.

In recent years, a larger number of banks and mortgage companies stopped offering HELOCs due to the perceived risk, especially for liens in 2nd position. If lenders may soon be able to quickly unload the funded HELOCs over to Freddie Mac, they may be inspired to offer these types of riskier loans again.

Whether it’s a federal bailout of lenders, homeowners, small businesses, billion-dollar corporations, or consumers drowning in credit card or student loan debt, all of these actions are inflationary and will likely make the dollar weaker and weaker.

Because government spending is likely to keep exceeding all-time record highs, these inflationary actions may help boost real estate values that are generally hedged against inflation.

Please try to pay off any double-digit consumer debt, set aside cash for you and your family if possible, and keep your eyes wide open for potential discounted real estate bargains in a neighborhood near you.

Rick Tobin

Rick Tobin has worked in the real estate, financial, investment, and writing fields for the past 30+ years. He’s held eight (8) different real estate, securities, and mortgage brokerage licenses to date and is a graduate of the University of Southern California. He provides creative residential and commercial mortgage solutions for clients across the nation. He’s also written college textbooks and real estate licensing courses in most states for the two largest real estate publishers in the nation; the oldest real estate school in California; and the first online real estate school in California. Please visit his website at Realloans.com for financing options and his new investment group at So-Cal Real Estate Investors for more details.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.