By Jay Butler

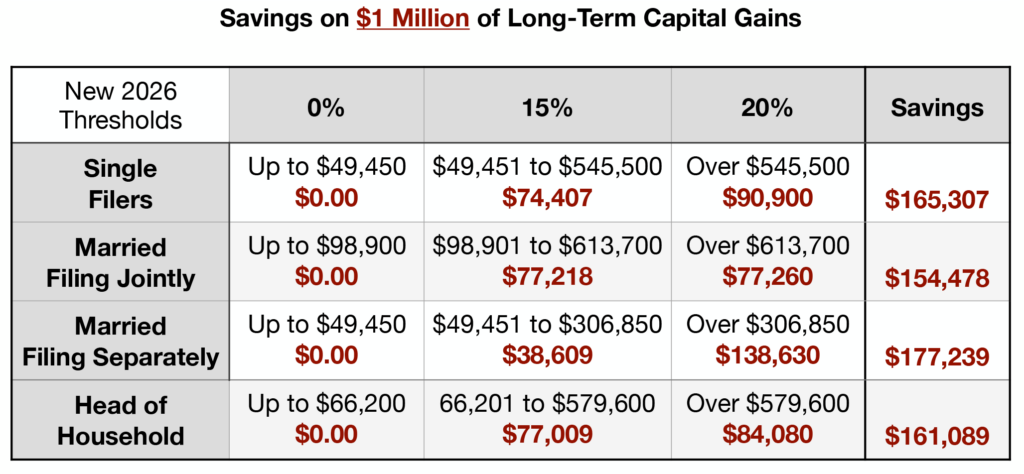

While some individuals and couples might escape low capital gains taxation under the new 2026 thresholds, most all investors will incur a capital gains tax liability upon the sale of an investment property.

The Scenario

So, in our scenario, “Bob” previously invested into a duplex. At the time of his purchase, he put $200,000 down toward his $500,000 acquisition. Over the years he invested another $200,000 improving the two units and eventually took-back $200,000 in depreciation. The property values continued to grow in his area and, when he decided to sell, the duplex had appreciated to $1.5 Million in value. Bob contemplated his $1 million in long-term capital gains tax dilemma and asked himself, “Could there be a way to legally and lawfully avoid paying any capital gains tax?” He would soon realize the answer was “yes”.

article continues after advertisement

On a side note, prior to purchasing, Bob had considered using a Self-Directed IRA or Roth to build his real estate portfolio – but elected not to take advantage of either. The minor costs involved in establishing an LLC structure and paying annual custodial services were not a deterrent. Even risks of turning the entire retirement account into a taxable event because of a self-dealing or prohibited transaction were not insurmountable. But the taxes would still come due for the Self-Direct IRA as they were withdrawn during retirement and, for the Roth, taxes would have already been paid going in. It’s not that either option was inherently bad, but neither choice was fully ideal – and so he left the property in his name.

Back to today, depending on his marital status and tax filing election, Bob was looking at paying a substantial amount in long-term capital gains tax under the new 2026 thresholds and he wasn’t keen on relinquishing it. Bob considered utilizing a 1031 exchange at the time of the sale but, while that was an intriguing idea, he would be forced to invest into another property of like-kind in a limited period of time. He needed a way to invest freely, as he saw fit, without all of the rules, risks and restrictions. Bob wanted to pay-down debt on other properties he held, reducing stress and increasing cash-flow. He also wanted to diversify his investments into precious metals and cryptocurrency, and desired to help his children with their college education and medical bills. Being tied-up in yet another real estate investment until retirement wasn’t going to help him accomplish his goals either.

The Solution

Bob chose to seek other existing solutions, and discovered the Benson Financial Irrevocable Spendthrift Trust. When he read the Legal Opinion drafted for an authorized agent Asset Protection Services of America Trust, he realized the answers he needed could be found within their proprietary trust instrument. Bob learned the original trust documents were drafted by two attorneys and Harvard School of Law professors. The first, Austin Wakeman Scott, authored the nine-book volume “Scott on Trusts” recognized as the leading treatise and authority on trust law in America. And the second, his protege’ Robert N. Benson, an experienced attorney who worked with a prominent wall street law firm providing legal acumen to high-net-worth individuals.

Their combined knowledge and experience enabled them to draft a trust based on contract law, established entirely upon the constitutional laws of our nation. Not only was their unique trust structure legal and lawful to the core, its very essence was rooted in the Internal Revenue Code and Treasury Regulations, and is supported by case law. In-fact, their trust documents were Copyrighted in 1999 as an original work. The Copyright Office duly noted that it was the first and only trust in American history to have ever been copyrighted. Having never heard of such a thing, Bob was encouraged to know the trust had already been in use for over half-a-century. Nobody wants to be a guinea pig. Knowing over 125,000 other clients had successfully made use of the trust before him (over a period of 53-years without ever having lost an audit), gave Bob the peace-of-mind and sufficient courage to move forward.

The Strategy

Bob purchased a book containing the copyrighted trust and was provided assistance in making use of those materials. He received his Certification of Trust, and corresponding Employer Identification Number (EIN) issued by the Department of the Treasury, with the proprietary Trust Agreement and supporting documents. Bob then prepared to sell his duplex into the trust by calculating his “Basis”. Taking the purchase price of his property ($500,000) and adding what he spent on improvements ($200,000), Bob subtracted from that ($700,000) amount the depreciation already taken ($200,000) and had his “basis” amount for his sale ($500,000).

Purchase Price + Improvements

(Less Depreciation) = “Basis”

In keeping with contract law, a Bill of Sale was prepared for Bob and he sold the duplex out of his individual name and into the trust at the agreed upon amount of $500,000. A Promissory Note was executed in financial consideration for the sale, and title was transferred by Quitclaim or Warranty Deed. The duplex was listed for sale at $1.5 Million and Bob signed-off on all the closing documents in his capacity as trustee of the trust. After the property was sold and the closing completed, the entire $1.5 Million was transferred from escrow to the bank account under the name and EIN of the trust.

Bob did not incur any capital gains taxes on the sale of the property into the trust, as the amount of the sale was equal to his after-tax investment in the property, and saved him between $154,478 (Married Filing Jointly) and $177,239 (Married Filing Separately). Likewise, the Irrevocable Spendthrift Trust did not incur any capital gains tax from the sale of the duplex as, in accordance with the copyrighted trust agreement and IRC §643(a)(3), the entire sale amount was allocated to the corpus (or body) of the trust.

IRC §643(a)(3) – Capital Gains and Losses

“Gain from the sale or exchange of capital assets shall be excluded to the extent that such gains are allocated to corpus and are not (A) paid, credited or required to be distributed to any beneficiary during the taxable year, or (B) paid, permanently set aside, or used for the purposes specified in §642(c). Losses from the sale or exchange of capital assets shall be excluded, except to the extent such losses are taken into account in determining the amount of gains from the sale or exchange of capital assets which are paid, credited or required to be distributed to any beneficiary during the taxable year. The exclusion under §1202 shall not be taken into account.” [Emphasis Added]

The Savings

The entire $1.5 Million from the duplex property sale is now firmly in the trust’s bank account, without any taxes having been removed. Bob is the acting trustee over the trust and authorized signatory over the trust bank account. Thus “Trustee Bob” may, at his sole and absolute discretion, determine the “how, what, when, where, why, or even if” trust assets shall be utilized. Under the original and proprietary trust agreement, there are no requirements whatsoever for the trustee to distribute any monies to the beneficiaries during the taxable year. So, Bob is now free to pay-down existing trust debts and/or re- invest those monies into any other form, including but certainly not limited to, precious metals, cryptocurrency or even additional real estate investments which may, or may not, be of like kind – all in a time frame of his choosing. Here is what Bob saved on this transaction alone, and he could only imagine what that amount might grow to over time!

The Summary

The Trust is not a perpetual tax avoidance scheme, but a tax deferral mechanism, without all the cumbersome rules, risks and restrictions. Should Trustee Bob “distribute” cash to the beneficiaries, that could inevitably lead to a taxable event for the said beneficiaries. Distributions for health, education, maintenance and support (HEMS), are often taxable to the beneficiary if they consist of taxable income generated by the trust. However, if the distributions are from the trust’s principal, they generally are not taxable income to the beneficiary as indicated by standing IRS Private Letter Rulings. Additionally, IRC §2503(e) provides that qualified transfers made directly to an educational institution or medical care provider for someone else’s benefit are not subject to gift tax.

While the scope of benefits from utilizing our Benson Financial Trust exceeds the purview of this overview, upon Bob’s death, the trust experiences no probate court, no death tax, no estate tax, no inheritance tax, no generational-skipping tax, and no stepped up basis on trust assets. Instead, the beneficiaries may become the new trustees and immediately take-over control of all trust assets. Not even spouses of the new trustees may invade assets of the trust given the spendthrift provisions supersede pre-nuptial and post-nuptial agreements. This is how many wealthy families have taken humble beginnings and grown them into impressive estates, allowing the control of that wealth to be passed-on from generation to generation. “Own nothing; control everything.” You don’t have to wait to be a multi- millionaire to take advantage of our irrevocable spendthrift trust. Quite the opposite. Your chances of becoming a millionaire improve exponentially by taking advantage of our original, proprietary and copyrighted Benson Financial Irrevocable Spendthrift Trust.

article continues after advertisement

Documentation

Please visit our Irrevocable Spendthrift Trust webpage and download the Free Information Package with Legal Opinions on our Benson Financial Trust today. Visit us at www.AssetProtectionServices.com.

Consultation

To “Schedule an Appointment” just ‘click’ on the top right-hand corner of any page at https://www.assetprotectionservices.com/ and reserve your free 90-minute consultation now.

Disclaimers

“ Bob” is a fictional character and any resemblance to real persons, living or dead, is purely coincidental and unintentional. No representations or warranties are given or implied to render any accounting, financial, investing, legal, tax or other professional advice.

MEET JAY BUTLER

Jay Butler is the Trustee of Asset Protection Services of America Trust, Manager of State Trustee Services LLC and the former Vice-President of Sales and Marketing for Corporate Support Services of Nevada, Inc. Mr. Butler holds a Bachelor’s Degree of Fine Arts from Boston University.

Jay has provided customized business entity structuring for clients in all 50 states along with some of the most respected names in the industry including the Jay Mitton organization “the father of asset protection” and Real Estate Investor Association seminars. He also appeared in numerous magazine articles in Reality 411, Ca$h-Flow and REI Wealth.

While working with Wealth Protection Concepts, LLC under the tutelage of the former Las Vegas and North Las Vegas city attorney Carl E. Lovell Jr. (now deceased from Leukemia), Mr. Butler was bestowed the title of “Asset Protection Planner” for his competency and experience. He also co-authored the first edition of his book “Cover Your Assets: Legal Authorities on Asset Protection, Tax Strategies and Estate Planning” © 2006 with Dr. Lovell.

When residing in Zug, Switzerland, Mr. Butler was the Associate Director of “CO-Handelszentrum GmbH” providing Swiss company formation and administration services and executed a full-range of fiduciary responsibilities including client support and international corporate compliance services (KYC, FATCA, AML and FATF).

Jay builds his relationships through consistent attention to detail and reliable support. He has traveled extensively throughout the United States (having visited 49 of the 50 states), explored 40 nations worldwide, and has lived in a total of 7 countries throughout North America, Central America, the Middle East, North Africa and Europe. Jay holds dual citizenship in the United States and Italy and permanently resides with his wife and daughter in Puglia.

Asset Protection Services of America Trust

Jay Butler, Trustee

732 South 6th Street

Suite N

Las Vegas, Nevada 89101-6948

Office: (775) 461-5255

Website: www.AssetProtectionServices.com