|

Getting your Trinity Audio player ready...

|

Despite Inflation, Despite Interest Rates, Despite a Recession

“I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.”

—Warren Buffett

By Jeff Roth

Why to Not Worry About Inflation

Let’s take a look at inflation historically.

Yes the Consumer Price Index (CPI) is over 8%, and some say higher because they changed the way CPI is calculated over the years and does not include all items that may show inflation that consumers frequently need to buy.

However, real estate is one of the few assets that is performing well in this inflationary environment.

Values of properties have continued to go up higher than inflation. Buying investment real estate is using the power of inflation to your advantage because prices go higher with inflation because, sadly, the value of the dollar has gone down, and it takes more of those devalued dollars to buy the same house.

Even in 2022, prices are forecasted to go higher.

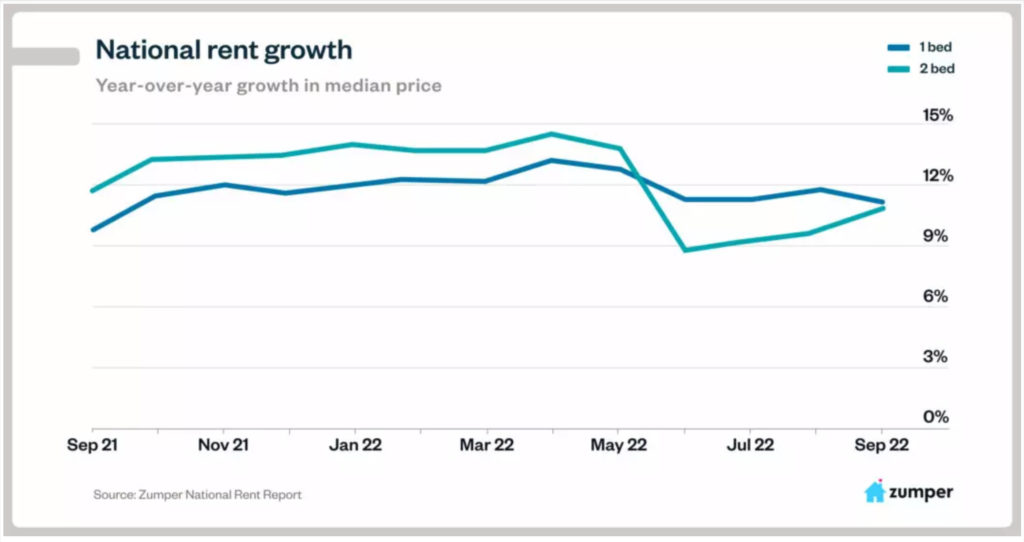

Rents have also increased greater than the rate of inflation in many places.

So, investing in real estate uses the power of inflation to your advantage.

What about high interest rates?

Why to Not Worry About Interest Rates

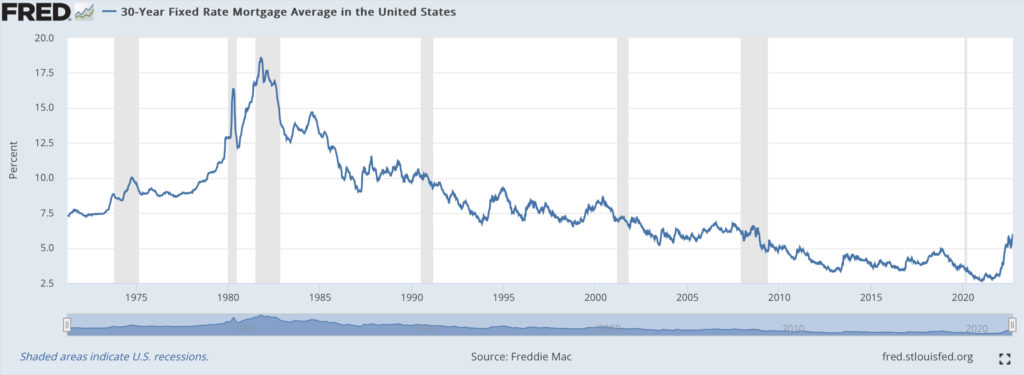

Yes, like inflation, interest rates are higher than we have seen in some time, and many would argue the rates were kept artificially low by the Federal Reserve.

So, historically speaking, how bad are interest rates?

Interest rates are elevated, but they still are not as high as they have been at some points in the nation’s history.

Also, if interest rates are lower than the rate of inflation (which they still are in many cases), then the effects of inflation mean you are paying back a long-term debt with dollars that are “worth less” over time because the value of the dollars you are paying the debt back with have been devalued.

Essentially, long-term debt, like mortgages, are an asset themselves in an inflationary environment.

Yet another reason to invest in 2022.

But what about a recession? Won’t that affect the housing market and real estate investments?

Why to Not Worry About a Recession

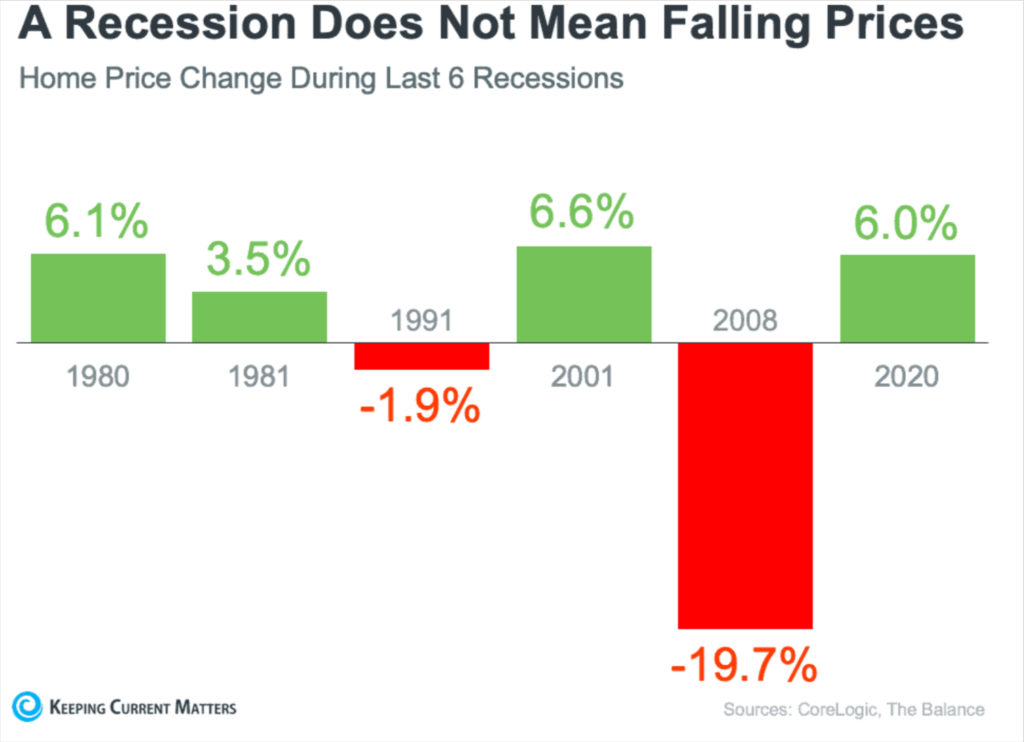

Home prices have gone up four of the last six recessions.

Part of the reason for this is the lack of housing supply to meet demand.

In fact, a recent study by Freddie Mac states there is a 3.8 million shortage of housing units to meet demand that would need to be built in the coming years in the U.S. https://www.yahoo.com/news/more-housing-coming-national-shortage-035900543.html

This new supply of housing units will need to be built while there is a shortage of skilled trade workers and lingering supply chain issues making material availability and costs unpredictable.

A good exercise, as an investor, is to ask where else can you invest your resources besides real estate and what returns you can expect.

ADVERTISEMENT

What Are The Investment Alternatives?

There are many alternatives to investing in real estate. Let’s see how they are performing.

Wage Growth- Surely, with all the job shortages reported, there has to be strong wage growth. Actually, according to the U.S. Bureau of Labor Statistics from Sept.13, 2022, real average hourly earnings are down 2.8%, seasonally-adjusted, from August 2021 to August 2022. Did you get a 9% pay increase this year to stay ahead of inflation? If so, you are doing better than most. https://www.bls.gov/news.release/realer.nr0.htm

Stock Market Performance- Year-to-date total returns for the S&P Index is down 17.12% according to MarketWatch. https://www.marketwatch.com/investing/index/spx

Bitcoin- Digital gold is down 57.76% year-to-date according to MarketWatch. https://www.marketwatch.com/investing/cryptocurrency/btcusd

Gold- The original safe haven investment is down 6.82% year-to-date according to MarketWatch. https://www.marketwatch.com/investing/future/gold

Small Business Performance- According to an article from April 2022 entitled “41 Small Business Statistics: Everyone Should Know,” only 40% of small businesses are profitable. https://www.smallbizgenius.net/by-the-numbers/small-business-statistics/#gref

So, if there really are no great alternatives to real estate investing in 2022 for the average investor, what is the cost for waiting and giving in to the media’s negative drumbeat about inflation, interest rates and a recession?

ADVERTISEMENT

What Are The Opportunity Costs For Waiting To Invest in Real Estate?

There are always costs for not making a decision or making a different decision with your resources.

Let’s take a look at the lost wealth over the next 5 years in lost equity if you wait or fail to invest in 2022.

According to Keeping Current Matters and the Home Price Expectation Survey, you would lose out on $102,787 from appreciation alone.

Additionally, you have three more opportunity costs for not investing in real estate in 2022:

1. Interest rates may very well continue to increase.

2. The money you have to invest will lose purchasing power from inflation.

3. The tax benefits from owning real estate will not be realized.

So, the question is, why wait?

Why Wait to Buy Real Estate?

Real estate appreciation and rent increases are greater than the rate of inflation.

Interest rates are still below the rate of inflation and below historical highs.

Home prices have gone up during four of the last six recessions.

All other investment alternatives are losing value in 2022 on average.

Waiting to invest will cost you future projected appreciation, interest rates may continue to increase, the money you have to invest will continue to lose purchasing power, and the tax benefits from owning real estate will not be realized.

Why wait to buy real estate?

To your success!

Jeff Roth

Contributor

Jeff is the founder of Arbor Advising. Arbor Advising is a consultancy based in Ann Arbor, Michigan that is passionate about helping people reach their financial goals with real estate and real estate investing in Michigan with an established record of success in various market conditions. Jeff believes in the value of education and is a contributor to many local and national real estate publications and organizations. Reach out for a confidential consultation to review your specific goals and objectives and join the many satisfied clients that work with Arbor Advising.

You can connect with him at:

www.arboradvising.com

[email protected]

https://twitter.com/ArborAdvising

https://www.facebook.com/profile.php?id=100083113851229

https://www.linkedin.com/company/arbor-advising/?viewAsMember=true

https://www.instagram.com/arboradvising/

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.