Is it time to rethink the way you think about funds and invest in them?

There are all types of funds. Some are far better and safer than others. Some see all the gains eaten up in fees and admin costs. Others generously pass on great gains to participating investors, even though their upfront estimates may have been modest. There’s a good chance that there is a place in your portfolio for some type of fund. Yet, most just don’t get the real advantages. They only see passive income and some stability in yields in the case of real estate funds. There are other advantages though, which more sophisticated investors are aware of.

THE OTHER ROI

“What’s my return?”

That’s the most common question novice investors ask when shopping and comparing investment options. “How much are you promising me?” That’s like shopping mortgage interest rates on your home loan. If you’ve financed a few homes, you know that the rate and terms you can get at the closing table may be WAY different.

What experienced and intelligent investors prioritize is another kind of ROI. The Return OF Investment.

It doesn’t matter if you’re promised the chance of 100x returns, if the chances you’ll lose everything are pretty close to 100% too. That’s the case with a lot of investments. Especially in the tech and startup world.

If you lose your capital you have nothing to reinvest. It is far better to make nothing in terms of returns on your investment, and just walk away with your capital back to try something else. A little icing on the cake, in yield, to cover inflation and lost opportunity costs on top of that would be nice too though.

So, what the most sophisticated investors look at is how likely they are to get their capital back in the worst case scenario. Think bank loans, mortgage lenders and even VC funds and Warren Buffett. What is this asset worth? If it completely fails to perform and the borrower or tenant goes broke, how can I get all my money back, and then have the chance to potentially sell it for a whole lot more? You think banks really did bad in the 2008 crisis? Probably not near as poorly as you think.

HOW TO OVER-COLLATERALIZE YOUR INVESTMENTS

So, how do you make sure that the risk-reward balance is so skewed in your favor when investing that you can’t lose?

Well, you can invest in mortgage notes and demand great spreads. You can buy properties for pennies on the dollar. Or you can choose great fund investments.

Over the past decade we’ve only seen problems ramping up. Virtually a whole industry of novices have popped up, overpaying for assets, without any plan for sustainability. Many are already seeing their assets dive into negative equity territory. It’s a catastrophe waiting to happen. Though a massive opportunity for others.

Here’s what’s cool about funds. Not only do the best have the ability to still buy assets in bulk, off market for pennies on the dollar, they can over-collateralize your investment with all of the assets in a fund. Let’s say you put $100,000 into a $1M fund. Well your capital technically has 10x the protection of your investment. Inside that fund there can be hundreds of assets too. So, you are never counting on a single asset to perform. In fact, even if 30% of them totally flop, you’ll still be fine.

In our diversified hybrid fund we’ve also built in multiple strategies and plays that are working for you at the same time. Redevelopments, buy and hold income properties, mortgages notes, etc. if one niche slows down, the others are speeding up. It’s a great way to not only ensure your return OF capital, but a return on your investment too.

Is your capital safe? Is your portfolio future proofed?

INVESTMENT OPPORTUNITIES

Find out more about investing in secured debt and real estate, go to NNG Capital Fund

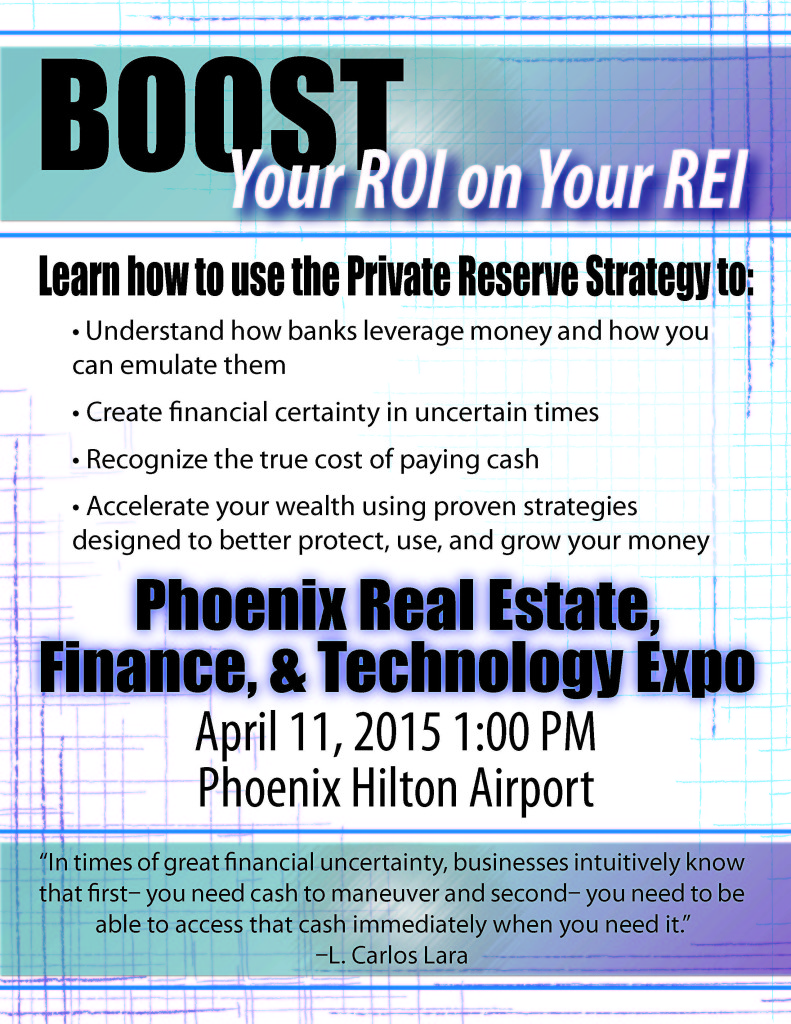

Our 5th Annual Los Angeles Real Estate Investors’ Expo will feature some remarkable experts. On that day, we will spotlight Rebecca Rice and Jim Beam, industry leaders in a little-known financial area. They’ve perfected a way to turn a unique and specific kind of life insurance policy into a reservoir of money you can use to simplify your real estate investing. More than that, the strategy actually compounds and increases the ROI on your investments.

Our 5th Annual Los Angeles Real Estate Investors’ Expo will feature some remarkable experts. On that day, we will spotlight Rebecca Rice and Jim Beam, industry leaders in a little-known financial area. They’ve perfected a way to turn a unique and specific kind of life insurance policy into a reservoir of money you can use to simplify your real estate investing. More than that, the strategy actually compounds and increases the ROI on your investments. Beam, who started as a real estate investor in Florida said, “We worked awfully hard to make our money. And it seemed like someone was always standing there at the end of the day with their hand out to take our money. Closing costs, fees, taxes, interest rates.” He felt there had to be a better way.

Beam, who started as a real estate investor in Florida said, “We worked awfully hard to make our money. And it seemed like someone was always standing there at the end of the day with their hand out to take our money. Closing costs, fees, taxes, interest rates.” He felt there had to be a better way. Rice discovered Nelson Nash’s book,

Rice discovered Nelson Nash’s book,  “The simplest way to use your Living Benefits policy is with hard money lending,” Beam says. “There are hundreds and hundreds of folks out there who are in need of hard money lending.” Beam works through organizations that send out leads for people who want to borrow the amount of money you have to invest —whether that’s $10,000 or $150,000 or more.

“The simplest way to use your Living Benefits policy is with hard money lending,” Beam says. “There are hundreds and hundreds of folks out there who are in need of hard money lending.” Beam works through organizations that send out leads for people who want to borrow the amount of money you have to invest —whether that’s $10,000 or $150,000 or more.