By Chris Heller, Co-founder of Agent Advice

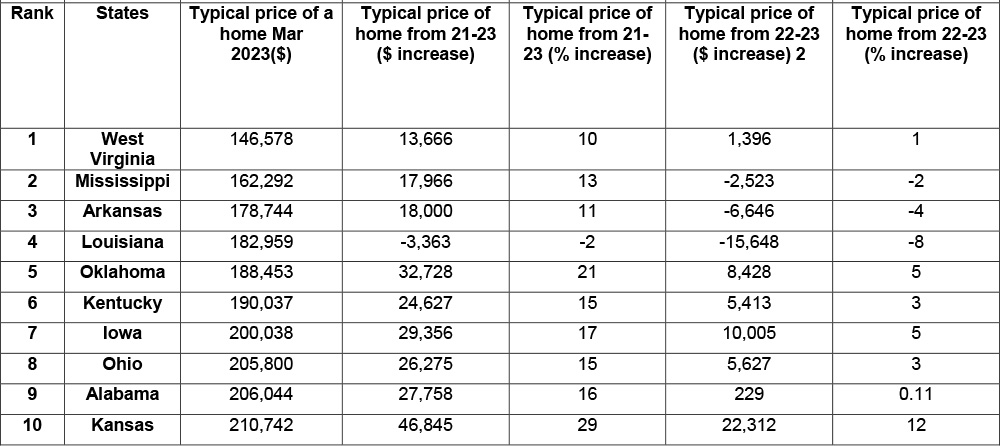

West Virginia is the least expensive state to own a home, with a typical house price of $146,578 as of March 2023.

article continues after advertisement

Mississippi, Arkansas, Louisiana, and Oklahoma round out the top five.

The study analyzed the typical cost of homes in America, as well as percentage and price increases from 2021 to 2023.

New data has revealed the cheapest states to own a home in America.

The research, conducted by real estate experts Agent Advice, analyzed the typical price of homes throughout the country from March 2021-March 2023. The data also considered price and percentage increases to supply a comprehensive account of real estate in America.

West Virginia takes the crown as the least expensive state to own a home. The research found that typical house prices were $146,578 as of March 2023, 57% less than the national average ($338,649). The typical price increased by 10% and $13,666 from March 2021, the second-lowest monetary increase in the United States, with a 1% and $1,396 rise between March 2022-March 2023.

Mississippi receives a silver medal as the second cheapest state to own a home. In the Magnolia State, a typical house price was $162,292 as of March 2023, 52% below the national average. The Southeastern state also has the third lowest monetary increase in house prices, with a $17,966 and 12% rise between March 2021-March 2023. However, typical house prices depreciated by 2% and $2,523 from March 2022-March 2023, showing a slight decrease in the last two years.

Arkansas ranks in third place. In the Natural State, typical house prices were $178,744 as of March 2023, 47% below the national average. The typical cost rose by 11% and $18,000 between March 2021-March 2023, standing for the fourth lowest monetary increase. The research also reveals typical prices decreased by 4% from March 2022-March 2023, saving house hunters an extra $6,646.

article continues after advertisement

Louisiana is the fourth cheapest state to own a home in America, with typical house prices being $182,959 as of March 2023, 46% less than the national average. The Pelican State stands for the highest reduction, rather than an increase in prices throughout America, with house prices falling by 2% and $3,363 between March 2021-March 2023, with an 8% and $15,648 reduction between March 2022-2023.

Oklahoma comes in fifth place. The research shows that typical home prices were $188,453 as of March 2023, 44% below the national average. This is 21% more than the typical house price reported as of March 2021, with a 5% and $8,428 monetary rise within the last two years.

Kentucky ranks in sixth place. The data has benchmarked typical house prices at $190,037 as of March 2023, 44% below the national average. Overall, property values increased by 3% and $5,413 from March 2022, and 15% and $24,627 from March 2021, the seventh-lowest monetary rise in the country.

Iowa is the seventh cheapest state to own a home, with typical house prices reported as $200,038 in March 2023, 41% below the national average. The Hawkeye State has experienced a 17% and $29,356 increase in property values between March 2021-March 2023, with 5% and $10,005 accounting for March 2022-March 2023.

Ohio, with a typical home value of $205,800 as of March 2023, is the eighth cheapest state to own a home. Alabama follows in ninth place with a typical price of $206,044, while Kansas rounds out the top ten at $210,742.

Chris Heller, Co-founder of Agent Advice, has commented on the findings: “The U.S. housing market is estimated to be worth $43.4 trillion in 2023. To take advantage of this, consumers and agents alike must understand the ever-changing nature of the real estate market.”

“Overall, there has been an increase in cost in the last three years throughout the nation. However, this research shows that there has also been a depreciation in multiple states over the last two years, showing a rise in more affordable housing.

“In Louisiana, for example, typical house prices have reduced by 8% and $15,648 within the last two years. So, it will be interesting to see if this trend in the cost of housing will eventually decrease throughout the country.”

The top ten cheapest states to own a home in America

Agent Advice is a team of real estate experts providing hand-selected recommendations to help real estate businesses grow.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.