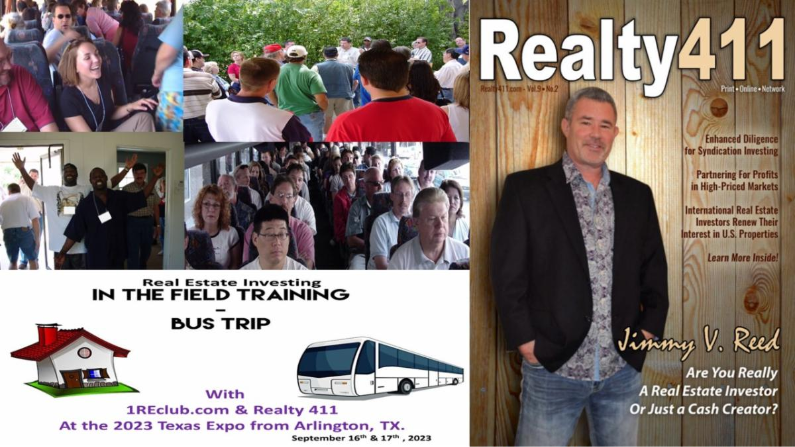

The Great Mile High Real Estate Investors Summit has partnered with Realty411, BRRRR Loans, Invest Success and Realty Investors Group to present the premiere Colorado-based Great Mile High REI Summit in Denver to be held on March 8 – 10, 2024. The Great Mile High Real Estate Investors Summit is not your ordinary real estate event. This multi-day REI extravaganza will host 30 speakers at the unique Curtis Hotel in downtown Denver. Enjoy educational and networking opportunities, happy hours, lunches, dinners, entertainment, and a property bus tour around Denver. Stay to hit the slopes and enjoy all that beautiful Colorado has to offer.

article continues after advertisement

There is an early-bird discount for readers and friends of Realty411 and REI Wealth magazines. To celebrate Realty411’s most recent Investor Summit held in Irvine, California last week, we have put together a special code of IRVINE100OFF for a discounted admission rate for Denver’s Summit. Be sure to use IRVINE100OFF at checkout for $100 off your summit ticket purchase.

A limited number of discounted hotel rooms at The Curtis Hotel Downtown Denver are available at a special rate of $179 per night. The regular rate for that weekend is from $200 to $300 per night. Be sure to act now before the room block is full.

article continues after advertisement

To find out more information about The Great Mile High Real Estate Investors Summit, visit: GreatMileHighREInvestorsSummit.com Be sure to also join the Summit Facebook Group for all the latest updates.

For companies or individuals who would like to inquire about speaking opportunities, please contact, [email protected]. See you in Denver this March for this life-changing summit with some of the nation’s top educators in real estate.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.