I wanted to let you know one of the people I respect the most in Real Estate, Marcella Silva…

She is hosting a special training called “Today’s Dirt Is Tomorrow’s Gold” and I just couldn’t resist telling you about it.

I wanted to reach out to you because I thought you or a friend or family member might want to learn about the best kept secret in Real Estate…Land Banking.

I KNOW you’ll get a ton out of this.

And knowing Marcella, you can bet nothing will be held back.

Here’s what you can expect when you show up:

- Secret #1: The TRUTH About The Hidden Wealth In Real Estate

- Secret #2: The Largest Global Shift Of Wealth

- Secret #3: The Laws That Are Causing The Largest Land Rush In History

The webinar is on Oct 25th, 2022 at 5:00 PM PDT

Click here to register:

https://register.gotowebinar.com/register/7137744040781665291

Marcella Silva is going to bust the doors wide open on how to:

- Reach financial freedom through land investments

- Have peace knowing you have an investment that is working without your effort

- Find and investment that goes up in value and is not subject to volatility.

It doesn’t get any better than that!

This will be perfect for you if you’ve ever said:

“I want to diversify My Portfolio”

“The only way my 401K goes up is when I put money into it”

“I’m sick of tenants, toilets, termites, troubles and taxes”

“The stock market is too volatile”

“My investments are stressing me out”

“I need to do a 1031 exchange”

Honestly, it doesn’t get any better than that.

It happens: Oct 25th, 2022 at 5:00 PM PDT

Go register now:

https://register.gotowebinar.com/register/7137744040781665291

See you on the training!

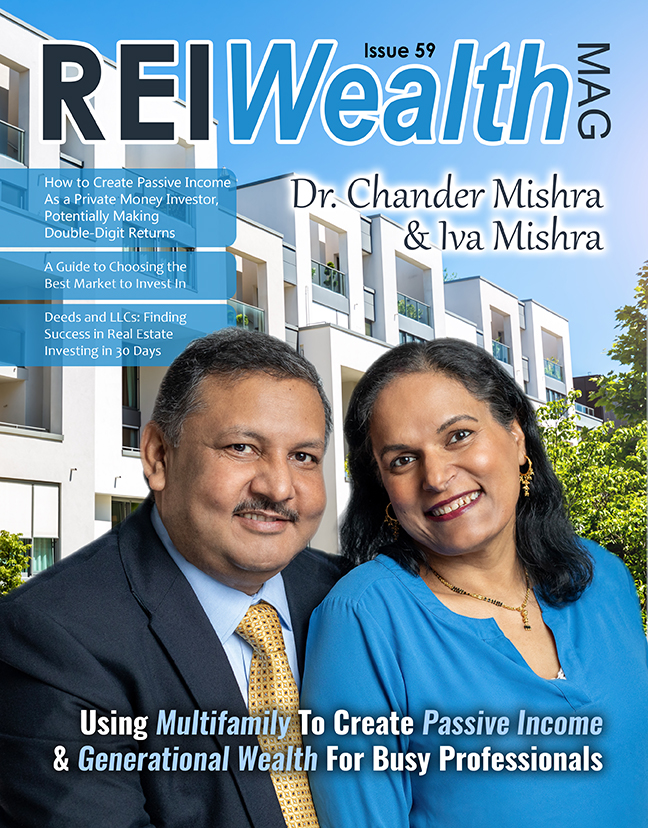

Linda with Realty411

P.S. This kind of training doesn’t come along very often, so I suggest

jumping on this. It’s gonna be GOOOOD!!

Founded in 2007, Realty411.com has assisted companies of all sizes and budgets expand their visibility and grow their business. Contact us for a complimentary marketing session: CLICK HERE. Investors, do you need a referral? Our investor network is nationwide:

CONTACT US – Ph: 805.693.1497 – Text: 310.994.1962 – CA DRE # 01355569