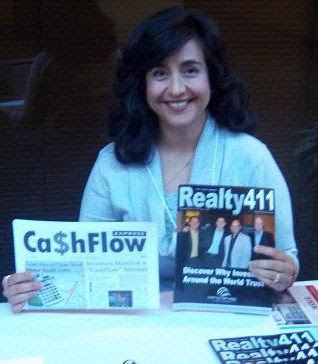

REI EXPO IN CHICAGO? Can’t wait to see YOU there!!! by Linda Publisher of Realty411

real estate magazine

Realty411 Magazine – SNEAK PEAK OF OUR MAGAZINE IN PRODUCTION!

Real Tech SF 2013 – Realty411 is Exclusive Media Sponsor

Real Tech SF 2013 is excited to announce the participating Sponsors and Starup Alley companies for this month’s event.

Here are the four Gold Sponsors, who will all have full-length exhibitor tables at the conference:

- Reesio – Next generation transaction management platform for real estate agents (no separate accounts needed)

- Realtor.com – Property search site operated by Move, Inc.

- ChargeAds.com – Empowers online publishers to expand and diversify ad inventory sales.

- Cloud CMA – Creates reports for real estate agents that can be used to win new listings.

Here is the one Silver Sponsor (non-exhibitor), who is also our sole media sponsor for the event:

- Realty411 — Publishes online and print media, and organizes events for real estate investors.

The Startup Alley portion of the event is comprised of 23 technology startups within the real estate space that will be demo-ing their disruptive, innovative products:

- Happy Inspector – iPad app for property inspections.

- Wigwamm – Auctions for rental property.

- Storefront – Marketplace for short-term retail space (pop-up stores, etc.)

- RealtyShares – Online crowdfunding for real estate investments.

- HomeZada – Allows homeowners to track maintenance, remodels, and other home data.

- Zumper – Apartment rental searches from verified brokers and renters.

- Producers Forum – Handles off-market/off-MLS transactions.

- iManageRent – Online property management for landlords, tenants, and building providers.

- Benutech – Online transaction management for real estate agents.

- EZ Coordinator – Online transaction management for real estate agents.

- Cozy – Online property management with a focus on payments and screening for landlords.

- Onvedeo – Video hosting and marketing platform for real estate agents.

- Keyzio – iPhone app to match home sellers/buyers that might not be actively looking.

- Comvibe – Online property management for companies with a focus on maintenance.

- MagicPlan – iOS app for capturing floor plans using the sensors in a tablet/phone.

- GoRefi – End-to-end, cloud-based app for refinancing a home online without an agent.

- HomeSmart Advantage Realty – Online brokerage with a deep focus on technology.

- Proxio – Global marketing product that helps agents market their listings worldwide.

- ListedBy.com — Online real estate marketplace with live bidding auctions.

- DoormanSF – Online property management for landlords in San Francisco.

- Pendo Rent — Online property management for landlords.

- Local-Insights — Predictive analytics, data visualization, and filtering.

- Kwelia — Uses predictive date to calculate what apartments should rent for.

Mark Thomas, Co-Founder & CEO, Reesio

Source: realty411guide.com via Linda on Pinterest

New Issue Preview… Who Is in Our Latest Issue??

Seven Streams of Income Here – THE 411 ON SATURDAY'S EXPO IN SILICON VALLEY

6 Steps to Financial Freedom by Publisher/Investor, Linda Pliagas

By Linda Pliagas, editor & publisher of Realty411/reWealth and Cashflow Express

Everyone yearns for abundance and financial security, it is a human desire we all share. It is a motivation ingrained in us as part of our survival mechanism.

While we all have this in common, only a limited few ever actually reach true financial security.

The statistics can be depressing. According to the Retirement Confidence Survey (2006), 53% of Americans have less than $25,000 in retirement savings. Plus, 30% mistakenly believe that they will only need $250,000 or less in total retirement savings.

One of the problems in our society is a lack of discipline in regards to saving. In fact, a recent study by Harris Interactive found that 57% of households do not even have a budget (2009 Financial Literacy Study).

In my 20 year plus career in journalism, I have interviewed many successful and wealthy people, from celebrities to company CEOs. Undoubtedly, a perk to this profession was being able to unlock their secrets.

I’ve compiled a list of important guidelines, which were followed by many of those who transformed their mediocre life and average paychecks into extraordinary wealth.

These steps are not easy to follow, but they will get you started on a disciplined path and lead you toward creating a wealth-conscious mindset.

1. Reduce Your Household Expenses.

In California, we have some of the highest real estate prices in the nation so reducing living costs can be a sacrifice. One move that I have seen many real estate moguls make is that they start off their portfolio with a multifamily investment.

For example, if you are a first-time home buyer (or even an empty nester), be open to the idea of purchasing a duplex or other multifamily property instead of a typical single family residence. This way, you can live in one unit and rent out the other for income.

As a landlord myself, I know it’s not easy to live near tenants, but if you screen your prospective renters correctly, it will reduce future nightmares. Be smart, let other people pay off your mortgage! You can always save money and then buy another home later, after you build a passive income stream.

2. Increase Your Formal AND Financial Education.

Did you know that earning a bachelor’s degree can increase your income by $25,000 annually? Plus, it gets better:

According to Census Data, earning a graduate degree will net a person another $20,000 per year — that’s $45,000 more, year after year!

Now, don’t complain about the high cost of education or how “hard” it is to go back to school. My former neighbor was in her 50s, running her own business and attending?graduate school part-time. It’s never to late!

It’s also important to keep in mind that universities do NOT teach people how to get rich. So on top of your formal education, start taking classes about investing.

Financial classes are taught at most adult schools and colleges for a nominal fee. I have also attended real estate seminars for many years and have learned great tips from a variety of mentors.

3. Be an Aggressive/Conservative Investor.

Although it may sound like an oxymoron to be both aggressive yet conservative, it isn’t. It’s all about planning. The amount of risk you take with your money should be related to your age.

The younger you are, the more risk you can handle. But, don’t be foolish: One should never invest in something they do not fully understand. If stocks interest you, start learning about the market.

Learn how to decipher financial statements. If real estate is your game, start attending REIAs (Real Estate Investment Associations).

Also, don’t get greedy! I’ve known investors so desperate for that 20% return that they gave their money to unscrupulous companies only to never see their principal again!

Guard your principal, settle for less interest if need be. If the money is lost, it can take years to rebuild.

4. Don’t Follow the Crowd.

Most Americans are broke, why on Earth would you follow their bad habits? Trying to keep up with your neighbors can destroy your chances of financial freedom. Also be mindful of competition between family members.

For example, some families love to outdo each other in their travels. It’s non-stop cruises, trips to Hawaii, and weekends in Las Vegas. But guess what? They’re BROKE!?

Some people who know me may make fun of my frugality. They can jest all they want because I’ll be laughing all the way to the bank!

Many wealthy people are odd and eccentric, I used to think that money made them like that, but now I realize that they just don’t care about what others think. It was probably this defiant attitude that helped make them rich in the first place.

5. Saving is Sexy, It’s Fun to Be Frugal.

If saving is a deplorable chore, you won’t do it. If clipping coupons and wearing off-the-rack clothes is beneath you, then you need to change the attitude.

Start making a game out of saving and being frugal. See how much money you can put away in the cookie jar each week. Before you spend a dime, consciously think about the action you are taking.

Figure out if there is a better way to get what you need at a lower cost. Can you buy it second hand? Does someone else you know need the same thing? Can you barter an item or service in exchange for what it is you need?

Hold on to your pennies because they can accumulate into a fortune.

6. Step it Up a Notch.

Let’s get one thing straight, the 4-hour-work week is a complete myth. The reality is: Success doesn’t come easy. If it did, everyone would have a few million dollars in their bank account.

The wealthy people I know, who were not born with a silver spoon, toiled endless hours to get where they are. Sometimes they worked two jobs just to be able to pay off college debt or save enough money for a down payment on a home.

Others returned to school and juggled employment and family obligations for many years.

If you are not happy with your lot in life and you feel you deser

ve better, don’t just wish it to be so and wait. TAKE ACTION.

Don’t be lazy, don’t make excuses, and don’t feel sorry for yourself. Stay positive, keep focused, and you will see abundance before you know it.

I hope these ideas will inspire and light your path towards financial freedom.

To your abundance,

Linda Pliagas

founder/publisher Realty411

https://www.realty411guide.com

I welcome your comments, please contact me at:

[email protected] or 310.499.9545