Our guest will be Adiel Gorel with ICG Real Estate Investments.

ABOUT MR. ADIEL GOREL –

CEO of International Capital Group – Keynote Speaker

Adiel Gorel is the CEO of ICG, a prominent real estate investment firm located in the San Francisco Bay Area. Since 1983 he has successfully been assisting thousands of investors with purchasing U.S. properties.

Through ICG he has personally invested in hundreds of properties for his own portfolio and was involved in the purchase of over 10,000 properties for ICG’s investors in Phoenix, Las Vegas, Orlando, Tampa, Jacksonville, Dallas, Houston, Austin, San Antonio, Atlanta, Nashville, Huntsville, Boise, Oklahoma City, Tulsa, Salt Lake City, to name just a few.

Mr. Gorel holds a master’s degree from Stanford University. His professional experience includes Management and Director Positions in firms including Hewlett- Packard, Excel Telecommunications, and biotechnology firms.

Join Us for an In-Person Event in Irvine, CA-

LEARN FROM SOPHISTICATED INVESTORS

Be sure to join us IN PERSON. We will have wonderful resources, plus guests will have access to private capital, plus business and commercial funding as well. We have investors joining us from across the nation for one day of networking.

Our educators will be providing valuable insight, including:

Kaaren Hall, uDirect IRA Services, LLC

Hector Padilla, HP Capital Investments

Christopher Meza, Real Titan Acquisitions

Paul Finck, The Maverick Millionaire

Rusty Tweed, TFS Properties

Barry Duron, AltLender Mortgage

Jeremy Rubin, The Friendly Flipper

Kris Miller, Legacy Wealth Strategies

Deborah Razo, Women’s Real Estate Network

Julie Harrison, Buy Direct Mississippi

Emily Nesselroad, 3 Fives Properties

Paul Wilkins, Approved Inheritance Cash

Jim Edenfield, Invest Success

Tim Emery, The Great Mile High Real Estate Investors Summit

AND MANY MORE!

Now is the moment to grasp this opportunity — the chance to network with sophisticated investors from California and around the country. Join us for our special REI conference.

Be sure to pencil this date now and join us in-person to gain specialized insight and knowledge. The information shared on this day could catapult your portfolio to new levels. Discover our new property portal, our VIP perks, plus connect with new and past industry resources.

Advertisements:

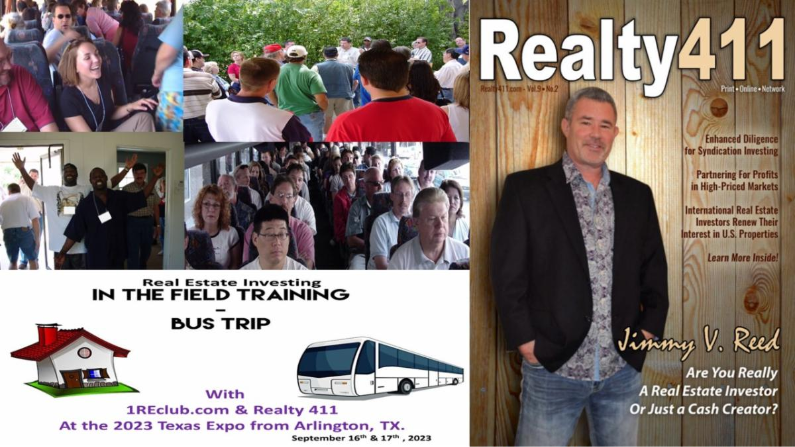

– Join Us for Realty411’s Lone Star Wealth Summit –

Are you ready to grow your real estate portfolio to new levels of abundance? If so, be sure to join us for Realty411’s new Lone Star Wealth Summit.

Investors, Realty411 is hosting a Real Estate WEALTH Summit & In Field Bus Training in Arlington, Texas on September 16th & 17th.

Enjoy a day of learning and networking. Our educators include:*

* Chander Mishra MD MBA CPE FASE FASA FAACD – Blue Ocean Capital

* Bob Bluhm, Esq — Asset Protection Attorney & Public Speaker

* Joseph Kimbrough- Apex Real Estate Investments

* Brian Carlson – Subject-To Real Estate Academy

* Joseph V. Scorese – BRRR Loans

* Brad Blazar – Capital School

* Steve Davis – Total Wealth Academy

* Jimmy Reed – 1REclub.com

* Jonah Dew – The Money Multiplier

* Jim Edenfield – Invest Success

* Tim Emery – Great Mile High Investor Summit

* Arnie Abramason — Texas Tax Sales

* Joel M. Desilets – Damascus Partners, LLC

* Paul Finck, The Maverick Millionaire ®

* AND MANY MORE!

This is our first Lone Star Wealth Summit with the Bus training since 2018. Make sure to register now for both events in Arlington, TX.

The Wealth Summit is on Saturday September 16th in Arlington, TX. The link below will help you register and learn more about the Guest Speakers and Schedule of events.

Register now and you get in the Expo for FREE. However, tickets are limited and will not last. Be sure to read information about the In- Field Bus Tour on Sunday, September 17th.

Advertisements: