By Stephanie Mojica

SACRAMENTO – In the wake of a recent statewide consumer alert on identity theft and rental properties, the California Department of Real Estate (DRE) is once again sounding the alarm. This time, the focus is on an emerging false identity scam targeting vacant land and unencumbered properties. With a surge in real estate fraud involving identity theft, law enforcement agencies and District Attorney’s offices across California are urging more than 434,000 DRE licensees to stay vigilant.

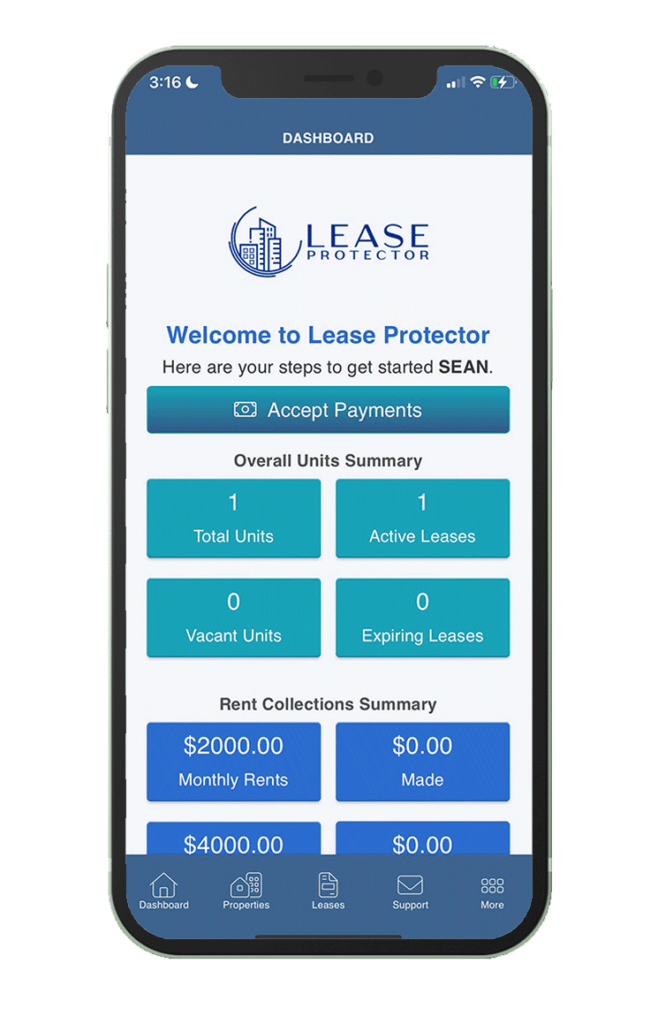

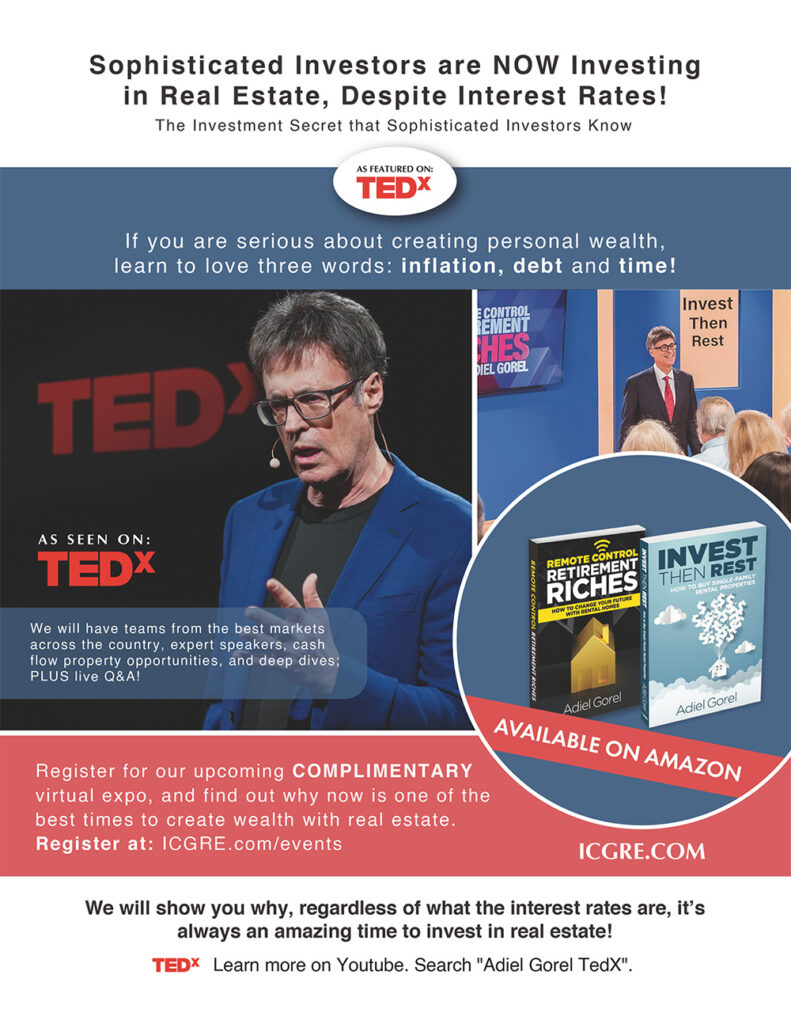

ADVERTISEMENT

The scam entails fraudsters scouring public records to identify properties without mortgages or liens, especially vacant lots, long-term rentals, or vacation homes often owned by vulnerable populations such as the elderly and foreigners.

Posing as the property owners, the criminals contact real estate agents, seeking assistance in selling the properties that they do not actually own. They lure agents with offers to list the properties below market value to generate quick interest, while ensuring no “For Sale” signs are displayed. They prefer cash buyers, demand rapid closing, and evade in-person meetings by relying on email, text, and phone communications, refusing video calls. To add another layer of deceit, they employ their own notary, who provides falsified documents to title companies or closing attorneys, insisting that proceeds be wired directly to them.

Detecting this scheme can be challenging, but real estate agents must exercise due diligence by verifying the property owner’s identity before accepting a listing. To protect themselves and their clients, agents are advised to:

1. Request in-person or virtual meetings with proper government-issued identification.

2. If an in-person meeting is not possible, require the use of a third-party identity verification service.

3. Conduct thorough online searches to verify the owner’s identity, including checking for recent photos and contact information.

4. Send a copy of the electronically signed listing via overnight mail to the property’s address on record, asking for confirmation from the actual owner.

5. Obtain a copy of a voided check with the seller’s disbursement authorization form from the property owner.

6. Use a wire verification service to ensure that wire instructions match the account details provided on the seller’s disbursement authorization form.

ADVERTISEMENT

DRE strongly encourages brokers to establish written policies regarding listings for properties where the licensee and seller have never met in person.

Should any suspicious real estate fraud cases arise, agents are urged to report them to local law enforcement or their District Attorney’s office. If another real estate licensee is potentially involved in the fraud, the information should be provided to DRE through its Enforcement Online Complaint System.

Vigilance and proactive measures can help thwart these scams and protect both real estate professionals and property owners from falling victim to such deceptive practices.

Stephanie Mojica

Stephanie Mojica, writer of How One Writer Shifted From Settling for $12 an Hour to Prospering at Over $90 an Hour and shorter books such as Quick Answers to Frequently Asked Credit Questions, is an award-winning journalist with publications such as USA Today, The Philadelphia Inquirer, San Francisco Chronicle, and The Virginian-Pilot, among many others. She helps executive coaches, business consultants, business owners, attorneys, and other decision makers generate more money online and become the go-to expert in their field by guiding them step by step through the process of writing and publishing a book.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.