Date:

Wed, 11 Mar • 02:00 PM

Location:

Online

Join us as Mark Robbins, J.D., CEO of Lending Resources Group, Inc., shares important insight on this webinar. For this session, our topic will be: “LEARN ABOUT THE IRA ADVANTAGE.”

Realty411’s latest webinar will help real estate investors and broker/agents gain access to timely real estate investing education.

Our goal is to make a fantastic online environment where learning and growing are key. We hope to assist as many estate investors and professionals as possible on their journey towards success.

OUR FEATURED SPEAKER: Mark Robbins, J.D.

Topic: Learn About the IRA Advantage

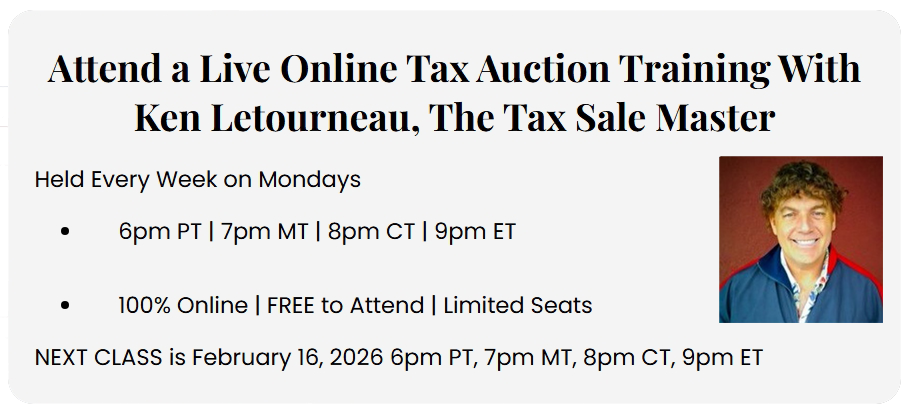

article continues after advertisement

ABOUT THIS WEBINAR:

This webinar is a focused training session on Learning About the IRA Advantage for real estate investors, real estate agents, private lenders, CPAs and attorneys.

We’ll walk through the importance of Individual Retirement Accounts. We’ll also share case studies and practical insights that can be immediately applied.

If you are, or work with: Investors, landlords, or anyone considering selling rental property, this session will give you the knowledge and confidence to add value.

OUR EDUCATOR:

Mark Robbins Biography – Lending Resources Group

Mark Robbins has pioneered non-recourse financing for IRA investors since leveraged financing became available to the public through a small bank in the Midwest in 2004. Since that time only a few select banks even offer these loans. He has established and maintained relationships with these lenders over the past twenty years.

Mark has obtained non-recourse loans, per IRS regulations, for numerous real estate investors in more than 30 states including Hawaii. Mark is a preferred provider for many of the IRA servicing companies including the Equity Trust Company, uDirect IRA, the Provident Trust Group, Entrust and many other IRA custodial and administrative providers for clients who require non-recourse financing for their IRA funded real estate investments.

article continues after advertisement

Mark graduated from New York University in Bronx, New York with a B.A. in History and Western State College of Law in Fullerton, California with a Juris Doctorate (J.D.). Mark is an entrepreneur and has operated several different businesses over the past forty years including a division of a major commodities investment firm, his own hi-tech executive search company and presently a commercial real estate mortgage brokerage company known as Lending Resources Group Inc. that he founded in 2007.

He has been a real estate investor and developer having designed and built four homes since 1982. He became a mortgage banker in 2002 with Bank of America and went on to work for CTX Mortgage, a division of the home building company, Centex Corp., in Dallas. Mark was recruited to start an in-house mortgage division for a popular townhome development company in San Francisco in 2006. That firm dissolved in the wake of the financial crisis in 2007=2008. During his tenure in mortgage banking, Mark has generated more than $120 million in residential and commercial mortgages for homeowners and investors nationwide.

PLEASE REGISTER HERE, WE WILL SEND A ZOOM LINK BEFORE THE WEBINAR.