By Stephanie Mojica

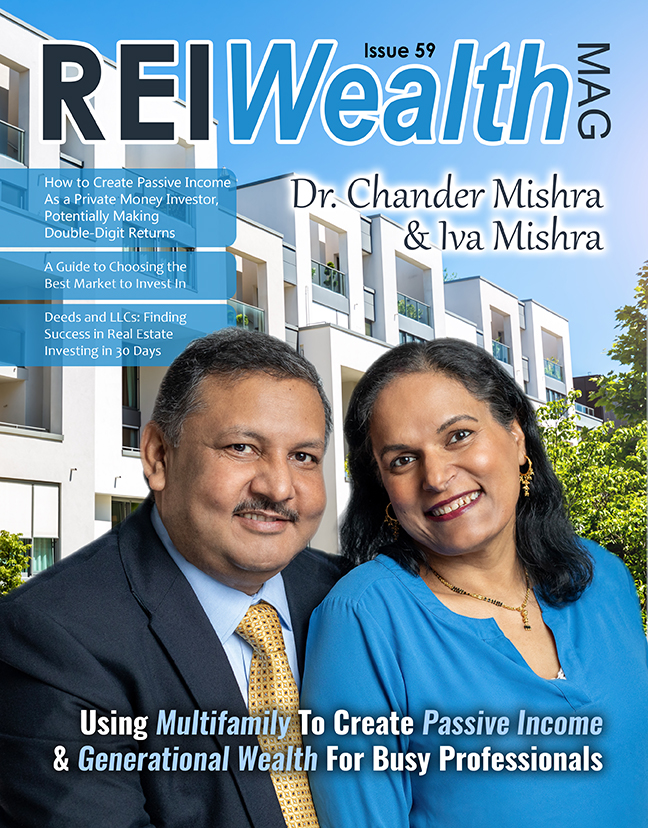

Navigating the ever-evolving landscape of real estate investment can be daunting, but for Dr. Chander Mishra and his wife Iva, co-founders of Blue Ocean Capital in Texas, the journey has been one of growth, learning, and strategic expansion. Their story is one of starting small, thinking big, and finding a balance between their professional and personal lives.

article continues after advertisement

From Humble Beginnings to Strategic Growth

Dr. Mishra’s exposure to real estate began early.

“Growing up in Delhi, India all I knew was real estate,” he said during a recent interview with Realty411. “Every weekend, our family would scout developing areas, buy land, hold it for several years, and then develop it. We did this five or six times in 25 years, generating substantial returns each time.”

This hands-on experience provided Dr. Mishra with a unique understanding of real estate dynamics, which later became the foundation of Blue Ocean Capital.

Iva’s experience with real estate also started at a young age, though in a different way.

“My father was a university professor, and wherever we lived he bought a home and then rented it out whenever we moved,” she said.

This simple strategy provided financial security for her father, particularly in his retirement years. Inspired by these family influences, Dr. Mishra and Iva ventured into real estate together, starting with land purchases and condo developments in 2003, before moving into single-family flips and eventually multifamily properties in 2016.

The Shift to Multifamily Properties

Like many real estate investors, Dr. Mishra’s and Iva’’s initial flipping foray was into single-family homes. However, they soon realized the limitations and challenges of this approach.

“Flipping single-family homes was difficult,” Dr. Mishra said. “We were dependent on others to complete the work, and there were frequent incidents of theft and delays. That’s when we started learning about multifamily properties, which were easier to manage from an operational perspective.”

Transitioning to multifamily properties was not without its challenges, but the decision paid off.

“We sold our single-family properties and started fresh with multifamily investments,” Iva mentioned. “We didn’t mix and match; we focused on building a portfolio that could provide consistent, long-term returns.”

Balancing Real Estate and Personal Life

Managing a growing real estate portfolio while maintaining a work-life balance is no easy feat, especially for Dr. Mishra, a busy physician, and Iva, a businesswoman raising two sons.

“It’s all about balance,” Iva said. “Having the right team at Blue Ocean Capital who understands our mission allows us to achieve continued success while still making time for family.”

Dr. Mishra agreed, adding that a clear division of roles and responsibilities is crucial.

“We look at our life as a single plane with different activities,” he said. “We hire key people to handle tasks we can’t manage ourselves. This approach makes it easier to grow and manage a large portfolio.”

article continues after advertisement

Navigating Market Challenges

The multifamily real estate market has seen its share of ups and downs, especially with fluctuating interest rates and increasing operational costs.

“Commercial real estate, especially in markets like Dallas, is facing some challenges,” Dr. Mishra said. “Interest rates, taxes, insurance costs, and inflation have all impacted property valuations and operational expenses.”

Despite these challenges, Blue Ocean Capital remains optimistic.

“We believe the market will bounce back as the Federal Reserve cuts rates,” Iva said. “We are continuously learning and adapting, always looking for new investment opportunities.”

Building a Legacy for the Future

Dr. Mishra and Iva are not only focused on their current success, but are also committed to building a legacy for their children.

“There’s no right or wrong age to start any venture,” Iva said. “Our sons are involved in the business whenever they can, learning the ropes and preparing for the future.”

Dr. Mishra added, “We teach our kids to have multiple streams of income. Real estate is just one way to do it. They can trade stocks, publish books, or even run a digital marketing agency. The key is to have more than one way to make money.”

Advice for Aspiring Investors

For those looking to follow in their footsteps, Dr. Mishra and Iva have some advice.

“Keep going, find your blind spots, and hire people who can fill those gaps,” Dr. Mishra suggested. “Every day is an opportunity to grow, learn, and create something new.”

Iva echoed his sentiments, emphasizing the importance of continuous learning.

“Real estate isn’t an overnight success story,” she said. “It’s a business that requires commitment, learning, and adaptability.”

Looking Ahead

As Blue Ocean Capital continues to grow, the Mishra couple remains open to new opportunities.

“We are actively syndicating and accepting funds for new projects,” Dr. Mishra said. “The market is opening up, and we’re excited about what the future holds.”

For Chander and Iva Mishra, real estate is more than just a business; it’s a lifelong journey of learning, growth, and giving back.

“Our mission is not only to build wealth, but also to help all professionals learn about the benefits of real estate investing,” Dr. Mishra said. “We believe in the cycle of learning, earning, and returning.”

The Mishra couple’s approach to real estate investment serves as an inspiring example for others looking to enter the market, emphasizing the importance of resilience, adaptability, and a long-term perspective.

To schedule a free 15-minute call, visit: https://bluoceancap.com/, email: [email protected], or call: 817-663-1887.