By Dan Harkey

Educator & Private Money Finance Consultant

949 533 8315 [email protected]

Visit my website at danharkey.com

Introduction:

“Private money, hard money, and bridge loans” are used interchangeably:

These loans refer to alternative lending sources separate and distinct from banks and institutional lending. One or more private investors/lenders fund each loan. Pools of investment capital accumulated with many private parties are also frequently used to finance private money loans. A sponsor/manager will be formed for pooled entities to fund many loans and manage the servicing.

Private money lending stands out when traditional banks decline, or the loan transaction is non-bankable. It’s a solution for property-related issues that need to be resolved, such as completing a partially constructed building or increasing occupancy in an income property with excess vacancy.

Transactions where private money loans benefit borrowers.

*Fast loan approval with possible 2-to-4-day funding for bank declines and fallouts: The bank may already have done significant underwriting, including opening escrow and title, obtaining an independent appraisal, and completing the application and financials. Some private lenders can use the banks’ information to fund faster, particularly when they have a mortgage pool or immediate capital available to invest.

*Debt consolidations for consumers, businesses, or a combination of both: In most cases, a funded loan is used for debt consolidation, lowering the borrower’s monthly payment obligations. The funded loan should give the borrower some breathing room to improve their credit and obtain a long-term bank loan. Also, if the loan is a second lien, the average interest rate between the first and second is calculated to show a ”net-effective rate.”

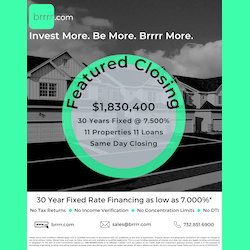

article continues after advertisement

*Marginal to poor creditworthiness, where a borrower is not bankable, and approval of a loan request is primarily property equity-driven.

*Special purpose-unique properties– Churches, synagogues, restaurants, bars, automotive repair shops, body repair shops, gas stations, and other single-purpose or limited properties.

*Limited document loans where the requirement is a loan application, credit report, and three to six months of bank statements. The objective is to prove the ability to pay the outstanding loan payments and other debt obligations.

*Fresh start loan. Borrowers may need to catch up and give themselves breathing room for accrued and differing payments.

*Payoff loans coming due or past due: Refinance and pay off existing first, second, and third lien position loans that may be due. Sometimes, refinancing the second and providing cash out is the appropriate answer to the loan request. Loans are available for both owner and non-owner-occupied residential and commercial properties.

*Cash-out for any reason refinances based upon the protective equity of existing real estate. Proceeds may be for business and consumer purposes. The Federal Government and some states, such as California, require a special license to engage in consumer-purpose lending.

*Junior lien or second-position loans on both owner and non-owner-occupied dwellings for business purposes.

*Construction completion, rebuilding, or upgrading properties in poor or marginal condition: The loan is usually necessary because the collateral property or the borrower needs to meet bank underwriting guidelines in its distressed or partially completed state. Loan approval by the lender will consider the as-is-value and the as-completed-value.

*A borrower may own and operate a cash-based small business with limited financial strength, as the books show. A lender will require 3 to 6 months of personal and business bank statements. The borrower must still prove that they can make the required payments.

*Leveraged existing real estate equity developed over time to borrow additional funds, purchase other investment properties or invest in a business enterprise.

*Purchase a property with some cash down payment, sweat equity, and seller’s agreement to carry back a subordinated junior lien. The property seller would have the borrower sign a promissory note and a deed of trust with a set interest rate, payment schedule, and due date. The subordinated second is recorded concurrently with the first trust deed but with a recording number after the first.

*Inherited property where family members and successor trustees who are beneficiaries need funds for distribution to the beneficiaries, pay the estate’s legal costs or fix up the property for a future rental. Another option is fixing it and selling it on the open market.

*Loan on unimproved raw land. Loaning on raw land can be a complex process. Is the land parcel part of an existing subdivision, referred to as an infill lot, a commercially or industrially zoned parcel within a subdivision, or a larger parcel held for future development? The borrower may need to use the property as collateral to raise funds for future entitlements, including engineering, architecture, various reports, and fees to develop a fully entitled parcel ready to be built. The borrower would pay the loan off as part of the construction loan.

article continues after advertisement

*Retail strip and community centers, industrial or other properties that require upgrades or repositioning: Many centers are distressed due to the COVID shutdown vacancies, where tenants could not pay rent.

*Fix-and-flip loans allow high-frequency purchasers to purchase a distressed property, rehabilitate it with the expectation of resale, and turn a quick profit. Borrowers need both experience and some of their capital at risk.

*Litigation settlements: A loan to buy out a business partner, pay off a pesky family member, an ex-spouse, a judgment lien, or a partition suit.

*Pay off civil judgments and liens, including arrearage in property taxes, association dues, and federal and state tax liens.

*Sale of existing promissory notes and deeds of trust to 3rd party investors: The sale is usually at a discount, whether the promissory note is performing or non-preforming. A deal will free up cash.

*Hypothecation or pledge of a promissory note and deed of trust: A borrower who owns a promissory note and deed will assign them to a third-party investor as collateral for a new loan.

*Cross-collateralization of more than one property: Multiple properties are required to meet the lender’s equity requirements. The borrower would sign one promissory note but have recorded liens that encumber two or more properties.

*Small mobile homes or trailer parks: properties that don’t meet the underwriting standards of institutional lenders.

*Vacation, Short-term, and rental income properties; Financials and history are necessary to prove the ability to make payments.

*New ground-up construction or construction completion for a partially completed project: Most requests result from borrowers needing to fund additional dollars to complete the project when they deplete their capital or existing construction loan proceeds.

*Collateral combines real and personal property, such as a motel, restaurant, carwash, or gas station with mini markets. A recorded trust deed encumbers the real property, and a UUC-1 financing statement will be filed with the Secretary of State to encumber the personal property. The valuation and decision to make the loan must be on the real property only.

*A long-term lease on commercial property has or is expected to expire soon. The lease expiration could cause a vacancy and a disruption in rental income. If the master tenant vacates the property, this will disrupt other smaller in-line tenants because the master tenant is responsible for the primary draw of foot traffic to the center. Banks will usually not make this loan. This loan is generally a bridge loan until the owner obtains a long-term lease with a credit-worthy tenant and manages the center back into stabilization.

*Credit approval is subject to highly sophisticated lease analyses, with multiple tenants having different lease terms, including length, lease rate, and lease provisions. Some tenants are on long-term leases, and some are on a month-to-month tenancy. Lease documents may include go-dark requirements for the anchor tenant or provide for lease cancellation in the event of excess vacancy or loss of an anchor tenant.

*Some properties require mutual property access easements for ingress/egress or complex usage rights, such as reciprocal parking agreements. Many properties, such as churches and retail shopping centers, sign contracts with multiple property owners to use the entry/exit of the property or the parking in specific ways or at certain times.

*Foreign nationals with and without social security. The borrower must have a U.S. bank account(s). The borrower must have a process agent service arranged during loan processing.

*“Notice of a substandard condition” or “notice of property noncompliance” is recorded on public records by a building department notifying the public that the property is out of conformance or in disrepair for building and zoning codes. The bridge loan funded by private lenders will provide funds to make substantial improvements and modifications to bring the property up to acceptable building, safety, and zoning standards. Institutional lenders will not make these loans.

*Non-conforming property does not comply with current zoning and building standards. As a result, strict limitations exist on repairing or replacing structures in destructive acts such as fire, flood, windstorm, vandalism, or earthquake. The property may not be able to be rebuilt to an acceptable level after the destructive event occurs.

*Earthquake seismic retrofit. Many older properties require upgrades, such as engineered reinforced steel frames bolted into the existing structure and walls shored up with steel support fasteners to withstand earthquakes.

*Tenant improvements. Commercial building owners must provide funds to install interior or exterior improvements to satisfy the owners’ and prospective tenants’ leasehold improvements.

*Cannabis-related properties, manufacturing, and retail facilities: Some states have legalized lending in cannabis-related operations, and others have not.

In summary, private money loans are collateral-driven, even though the lender must review the borrower’s financials to prove that the borrower can pay the debts.

If you find value in this article, please forward it to friends and associates. You may use this article in your marketing efforts.

Thank you

Dan Harkey

Dan Harkey

Dan Harkey is a contributing author to Weekly Real Estate News and is a Business & Financial Consultant. He can be contacted at 949-533-8315 or [email protected].

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.