|

Getting your Trinity Audio player ready...

|

By Jeffrey Grant

The financial news headlines are enough to cloud the mindset of any real estate investor wondering if the space is still a viable one — ongoing bank failures and interest rate hikes, recession fears, lingering supply chain issues and a stock market that reflects both unease and uncertainty. What should you do?

If you’re smart during this period, look for opportunities to grow your portfolio rather than cashing it out or just sitting on the sidelines. So-called safe havens might be right under your nose – if you do your homework first.

ADVERTISEMENT

In 2023, well-informed individual investors are looking to diversify their portfolios even during this time of turbulence and trepidation. While some are buckling down or momentarily bowing out, savvier investors are still pursuing a diverse mix of investments to position themselves to do more than just weather the storm. One ally in the battle can be private real estate investment offerings or alternative investment syndicates (alts) for accredited investors working with registered investment advisors (RIAs) or family offices. Private multifamily housing investments in particular are worth a closer look.

Alts, RIA, REIT and Multifamily Home Projects

Why alts, RIAs and multifamily? Because according to new research trending from AltExchange, nine in 10 advisors intend to increase alts allocations over the next two years, and because other financial advisors might not have access to for their clients or may get wrong. The nice thing about these investments is that they are non-correlated to the stock market. And they don’t come with the extra layers of management and other fees frequently found in traditional REIT (real estate investment trusts) or funds.

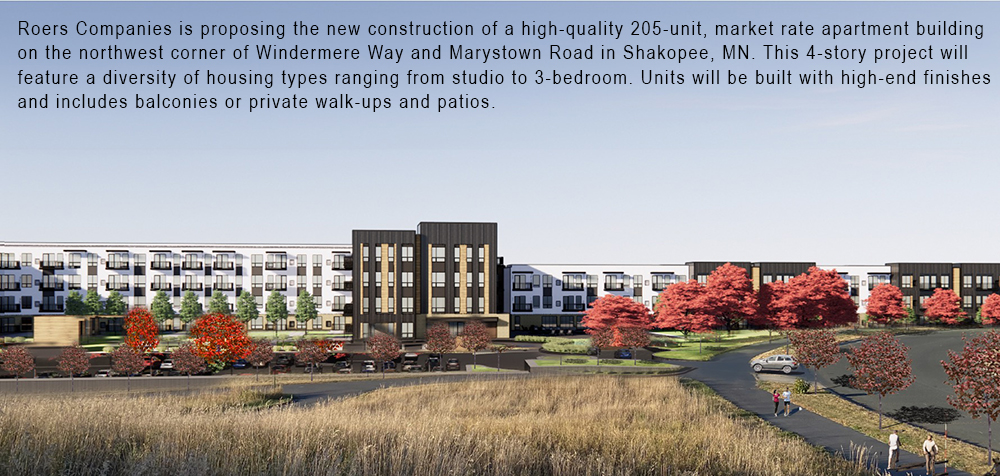

In many such REIT scenarios, they can be filled with basket-type portfolios – you have to invest in office, shopping centers and other property mixes that you might not be interested in, investment-wise. But select firms offering direct real estate exposure can offer a sound alternative to a REIT by offering investors the ability to decide which single projects to fund, thereby lessening their exposure to broader and more volatile product types. This is one advantage to working with an RIA connected to a private firm like the one I represent — Roers Companies — where we can offer direct investment in specific multifamily properties to accredited investors through the advisors they know and trust.

Multifamily housing demand remains high, and the housing crisis in major cities is widespread. Single-family homes are becoming increasingly too expensive to buy or build for the current and next generation of housing seekers. Single-family home construction is generally slowing, and interest rates are pricing out many potential homebuyers, which creates sustained demand for rental housing. So multifamily investing can be an ideal hedge in the current environment — again if you do your due diligence.

Check These Boxes: Scoping, Transparency, Frequent Reporting and Fast Lease-Up Rates

Eleven years ago, Roers Companies’ co-owners (and brothers) Kent and Brian Roers began developing multifamily properties in the Midwest. Now, the business they founded includes 10,000 apartment units and $2 billion in development across 14 states — proof, perhaps, that its one-stop business model is thriving. The leaders and their team have weathered more than a few storms, and they readily attribute tenacity during downturns and diversification as key to their sustained growth and success. But don’t just take my word for it.

According to Kurt Durrwachter, founder and CEO of the 13-year-old Ledge Wealth Management in Sartell, Minn., with nearly $400 million under management, Roers Companies has successfully differentiated itself. He says, “Their one-stop business model with development, construction and property management is very attractive. And their regular reporting of construction and other information offers the kind of detail we rarely see in this business. I think they’re pretty unique, and they have a highly successful leadership team that has done an impressive job of growing the company in just 11 years.”

Roers Companies reached that milestone largely on the strength of “friends-and-family investors” based primarily in Minnesota. That strategy helped them become a top-three Twin Cities developer, Minnesota Real Estate Awards’ 2023 Developer of the Year, and even rank among the Top 25 Developers of multifamily housing in the country, according to the National Multifamily Housing Council.

ADVERTISEMENT

Now their new initiative, working with RIAs and family offices, will allow Roers Companies to expand into additional markets where multifamily housing is needed and market fundamentals are solid. This next chapter in their story is also helpful in understanding the current and future opportunities that exist for anyone considering what the multifamily niche has to offer — even in a downturn.

One longtime Roers Companies investor notes how the company has done a superior job of checking all the key boxes investors look for.

“They have been very successful in just 10-11years’ time,” observes James Lee, “because they’re doing projects and making site selections in cities with projected job growth and housing shortages, especially in multifamily housing — and their fast lease-up rates are twice as quick as the industry average!

“The critical research, scoping and planning Roers Cos., does — plus the construction and leasing updates and quarterly reporting to their investors that offer true transparency — are often missing with larger investment firms. The returns,” he adds, “can be significant.”

Jeffrey Grant, Senior Managing Director, Capital Markets, leads the RIA initiative for Roers Companies, whose development pipeline is likely to include new ground-breaks in North Carolina, South Carolina and Tennessee in 2023.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411Expo.com or our Eventbrite landing page, CLICK HERE.