|

Getting your Trinity Audio player ready...

|

Image from Pixabay

By Bruce Kellogg

Introduction – Why Calculate and Analyze?

This is probably intuitive to most investors, but we calculate and analyze properties for the following reasons:

- To understand present operating performance.

- To project future performance under different scenarios.

- To compare alternative investment opportunities.

#1 – Cash Flow Analysis

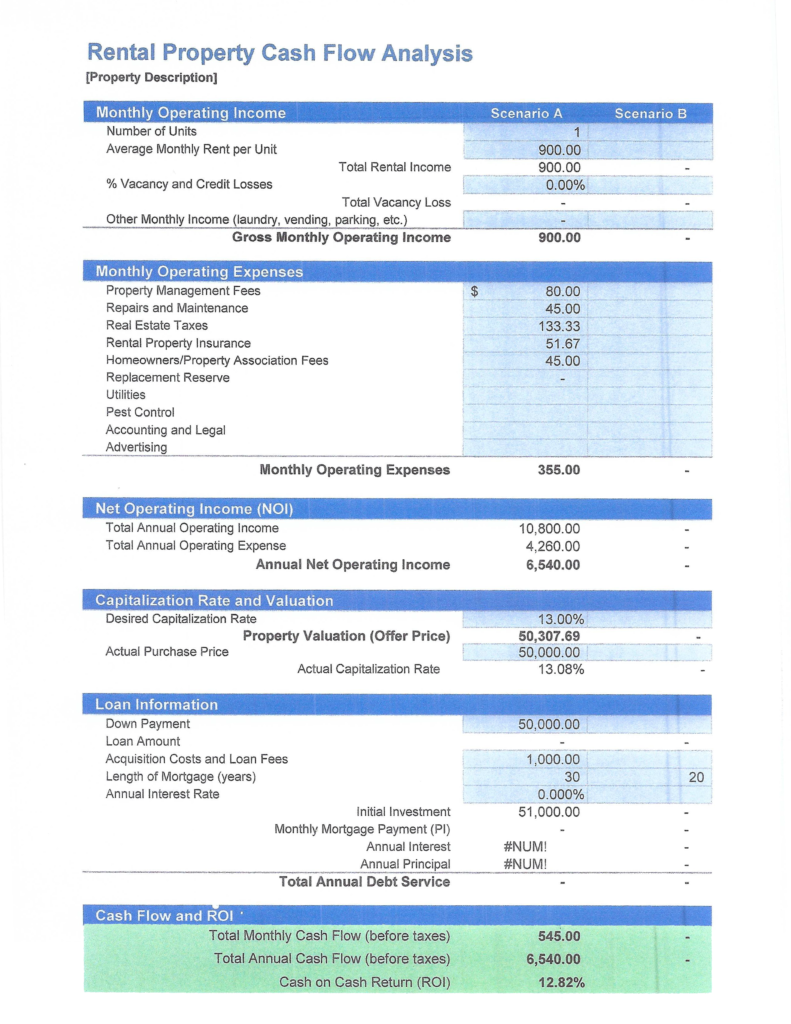

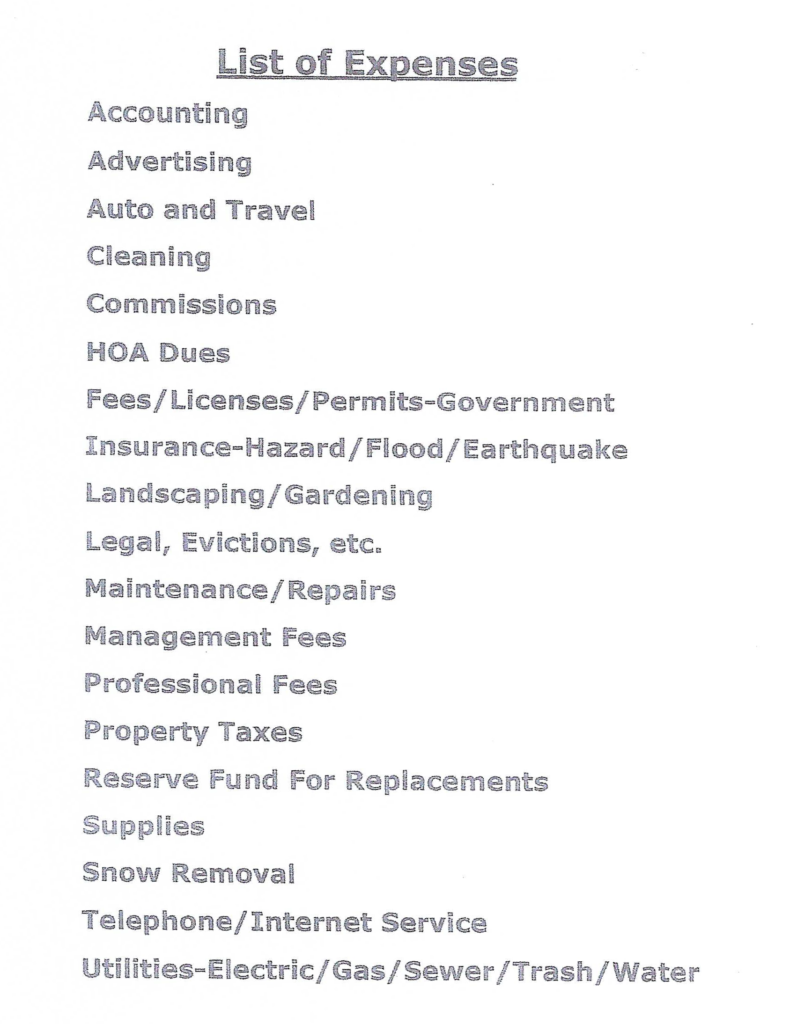

Figure 1 is a simple EXCEL™ spreadsheet that can be used for initial analysis of a property. Scenario A is typically the property’s present numbers. Scenario B is for “what if” analyses such as increasing rents, reducing selected expenses, or refinancing the loan structure. Figure 2 contains a larger list of expenses that should be used on this spreadsheet, and any others, to ensure that everything is accounted for.

A “quick and dirty” way to avoid applying every expense to a cash flow analysis is to estimate a percentage of rents, and use that. Say, use 35% if the property is under 5 years old, and the tenants pay most or all of the utilities. Go up to 60% of rents if the building is old, poorly-maintained, or the landlord pays most or all of the utilities. Initially, you might just use 50%. That’s pretty common. As you gain more experience, you can vary up or down, as described here.

#2 – Monthly Rent-to-Cost Ratio

This metric is used for initial screening, to see if you want to evaluate the property any further. Just divide the Monthly Rent by the Total Cost (Purchase Price + Rehab + Acquisition Costs), and express it as a percentage. You might want to do this twice, once for the present rents, then again for market rents if there is much difference. A result below 1.0% is not worth analyzing further under most circumstances. Above 1.2% you’re getting somewhere.

#3 – Gross Rent Multiplier (GRM)

The Gross Rent Multiplier is computed by dividing the Sale Price by the Gross Annual Rents. It is used to roughly compare properties as a screening method where higher is better. One caveat is that operating expenses are not considered, particularly who pays for utilities can make a big difference. It’s useful, but rough.

#4 – Capitalization (Cap) Rate

This is one of the most useful metrics for comparing real estate investment opportunities. It is best done using actual income and expenses from the previous year. Using it for pro forma performance projections is not as useful.

Cap Rate is computed by dividing the Net Operating Income (NOI) by the Total Cost (per #2, above), then multiplying by 100. Generally-speaking, the higher the Cap Rate, the better the cash flow. But one needs to consider property and location quality, as well because although a slum property might have a high Cap Rate, it still probably is an inferior investment. Inexperienced investors are misled by this sometimes.

Note that Cap Rate does not include debt-servicing costs. This is why different investments can be compared so readily using it.

#5 – Debt Service Coverage Ratio (DSCR)

DSCR is a favorite metric for lenders because it shows them how well the property will service the debt on it. It is computed by dividing Net Operating Income (NOI) by the Annual Debt Service, which includes both principal and interest, but not taxes and insurance. Most institutional lenders want the DSCR to be at least 1.2.

ADVERTISEMENT

#6 – Return on Investment (ROI)

Return-on-Investment (ROI) is one of the best measures of how your investment is performing. It is computed by taking the Gain on Investment minus the Cost of Investment, divided by the Cost of Investment. The Annualized Return is computed by taking the ROI and dividing it by the number of years the property has been owned.

#7 – Cash-on-Cash Return

Most of the time, investing involves the injection of cash which, for most investors, is limited. So, they want to know, “What is my cash doing for me lately?” This metric is computed by subtracting the Annual Debt Service from the Net Operating Income (NOI), then dividing by Cash in the Property. It is calculated on an annual basis, and is not appropriate for the first year. Additionally, a “cash out” refinancing will end its usefulness.

#8 – Internal Rate of Return (IRR)

IRR is especially useful when comparing returns on different asset classes. It is sometimes called “Discounted Cash Flow Rate of Return” because annual cash flows are discounted back to the total initial investment. The rate at which these equal zero is the IRR. It requires a financial calculator or software program to obtain this result. The HP-12C calculator and EXCEL IRR function are examples.

ADVERTISEMENT

Limitations

- The real estate calculations presented here all depend on quality data, which must be verified, if necessary. Some sources, like MLS listings and brokerage marketing materials, sometimes have errors or omissions.

- These calculations assume the investment property will not experience a “Black Swan Event”. The COVID-19 pandemic is an example.

- Additionally, performing calculations is “desk work”. It’s essential, but it needs to be coupled with “field work” for an intelligent investment to be made.

- Finally, the author recommends that after an investor does their calculations and conclusions, they share these with an experienced fellow investor, mentor, or consultant as a check on their work.

Bruce Kellogg

Bruce Kellogg has been a Realtor® and investor for 40 years. He has transacted about 800 properties in 12 California counties. These include 1-4 units, 5+ apartments, offices, mixed-use buildings, land, lots, mobile homes, cabins, and churches.

Mr. Kellogg is a contributor and copy editor for two national real estate wealth-building magazines: Realty411, and REI Wealth Magazine. He is a recipient of an Albert Nelson Marquis Lifetime Achievement Award, listed in Who’s Who in America– 2019.

He is available for consulting with syndication, turnkey, joint-venture, and other property purchasers and note investors nationally, and other consulting assignments. Reach him at [email protected], or (408) 489-0131.

Learn live and in real-time with Realty411. Be sure to register for our next virtual and in-person events. For all the details, please visit Realty411.com or our Eventbrite landing page, CLICK HERE.