DON’T MAKE YOUR SUMMER VACATION PLANS JUST YET

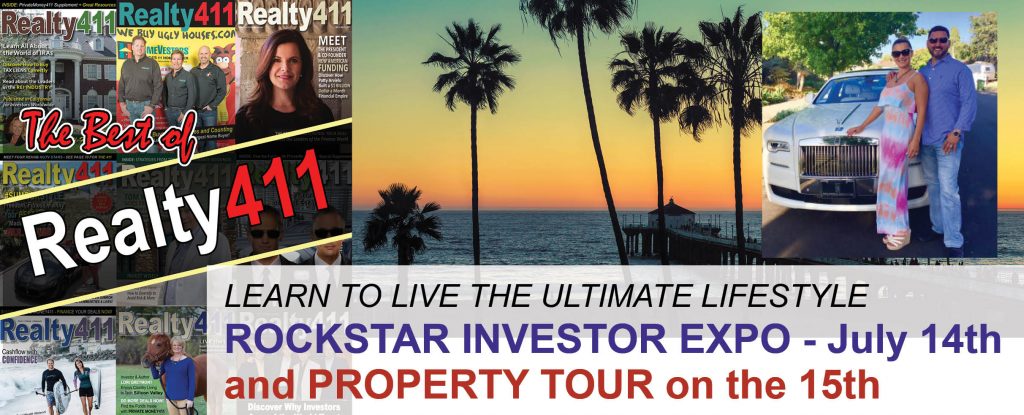

Schedule Your Holiday Around Our “Rockstar Real Estate Investor Weekend.”

We Have a JAM-PACKED Weekend this July 2018 — one designed for Maximum Learning and Up-Close and Personal Networking.

The “Rockstar Real Estate Investor’s Weekend” will Skyrocket Your Success!

This Realty411 Weekend, Includes:

- Complimentary Admission to Saturday’s “ROCKSTAR Real Estate Investor’s Expo” on JULY 14TH. RSVP HERE.

- Specialized Training on SUNDAY, JULY 15th, ROCKSTAR Rehab Bus Tour with One of the Most Active Investors in Southern California. RSVP HERE.

Celebrate Realty411’s NEW Print Issue:

“The Best of Realty411”

Are you ready to Grow Your Real Estate Business, Portfolio and Network?

We want this VIP EXPO TO EXPAND YOUR MIND and help you succeed.

OUR COMPLIMENTARY CONFERENCE & EXPO IS THE #1 SOURCE FOR INFO

The Westin Los Angeles Airport

5400 W Century Blvd, Los Angeles, CA

Saturday, April 14 | 9:00 AM — 6:00 PM

Property Bus Tour on Sunday, April 15th

FOR BUS TOUR DETAILS, CLICK HERE

Learn from TOP Leaders in the Industry!

Both Local & National Experts.

* Mingle with OUR MOST VIP Vendors * Meet Local Leaders & Out of Area Investors

* NON-Stop Tips for Real Estate Success ~ Bring Lots of Business Cards.

* Mingle with Local Leaders & Industry Professionals from Around the Nation!

Hosted by Realty411 – The Original Realty Investor Magazine Since 2007

FREE PRINTED BOOK FOR THE FIRST 200 PEOPLE, PLUS OUR BRAND-NEW MAGAZINE!

Not available elsewhere – These two gifts will inform and inspire you.

Realty411 magazine was first published in 2007 and is now the longest-running publication owned by the same owner – Based in Santa Barbara County, Realty411 has reached thousands of readers & online followers in person. We have the largest and most diverse social media of any other real estate investing publication.

Our mission is simple:

- We strive to provide information about real estate to expand knowledge about the benefits of investing to as many people as possible.

- We also believe in multiple streams of income and encourage others to own their own business for total financial freedom.

- Our Expo Reflects Our Goals and Mission – Join Us to Expand & Grow

Please bring LOTS OF BUSINESS CARDS, it’s time to Network.

LEARN ALL ABOUT PRIVATE FINANCE SO YOU CAN GET YOUR DEALS DONE!!!

We give your the resources you need to CLOSE MORE TRANSACTIONS!

Learn from Alton Jones, Your Local REI Powerhouse!

HERE IS HIS STORY:

“As the owner of Rehabs 2 Riches, I’ve spent my life making connections. Right out of high school, I joined the Los Angeles Police Department and became a police officer. During that time, I had a lot of interesting experiences, and I met a variety of fascinating people. Now, 30 years later, I’m still a reserve officer.

In 1996, I joined Primerica Financial Services and became a licensed life insurance agent, eventually rising to the position of Regional Vice-President. A few years later, things changed. I saw families and good people experiencing tough times due to a bad economy and a terrible real estate market. If things had been a little different, it could have been my family and I in the same situation.

I knew I wanted to help somehow, to give back. That’s what motivated me to earn my real estate license and establish West Coast Home Buyers, LLC., purchasing and remodeling homes to make them affordable for local homebuyers.

Working alongside my mentor, the legendary Ron LeGrand, 14 years of real estate experience taught me two things. First, rehabbing homes is a way to help others, giving them a chance to buy beautiful and secure homes. Second, by working hard and working smart, rehabbing can be highly profitable. These lessons led me to develop Rehabs 2 Riches, a series of courses and books designed to teach anyone how to seize financial opportunity for themselves.

Now, I have the privilege of passing on what I know and watching my students reach heights they never thought possible. I can’t wait to start working with you. For more information, or to take the first step, contact us by phone or online today!”

KEYNOTE SPEAKER:

Mr. Hector Padilla

Local Real Estate Multimillionaire Mastermind

Hector Padilla, a real estate broker, accredited investor and entrepreneur, is one Californian who has greatly benefited from the Golden State’s last 20-year-market cycles.

Beginning with his first purchase, a completely burned-down duplex in Los Angeles, which he purchased with credit cards and by breaking his childhood piggy bank… to his $75K Hollywood parking lot that he flipped one year later for $1.375M.

Hector Padilla is the American Dream personified; he become a self-made millionaire by age 29, multi-millionaire by 30 and was able to retire at age 38. He created his wealth via real estate investing right here in Los Angeles!

The Los Angeles-based investor mentored the Publisher of Realty411‘s on numerous real estate investments over the course of their 18-year friendship. The pair met when Linda Pliagas, magazine publisher, was hired as his first assistant.

How did Hector transition from being a REALTOR® to Flipper to now owning multimillion-dollar properties like a $6M building in upscale Brentwood, plus a $9M building in LA?

What are some of the strategies that this native Angeleno used to create exponential growth, all while being a family man and now living The Ultimate Lifestyle?

Discover Golden Nuggets from one of the Golden State’s most successful real estate investors.

In addition to sharing proven techniques that he has learned from his Mentors, closed deals, and from his investment of over $250K in RE education.

Hector will also reveal shortcuts that he has taken to expedite financial success so investors can savor “the good life” while they are still young enough to enjoy it.

To RSVP and secure complimentary tickets, while they last, CLICK HERE

DISCOVER HOW TO INVEST IN REAL ESTATE FOR MAXIMUM RETURNS WITHOUT TOILETS, TENANTS OR TRASH!

Christopher Meza, a Los Angeles native, has over 15 years of investment experience. With a Bachelors of Science in Computer Science and Electrical Engineering, he has worked for Fortune 100 companies like IBM and The Boeing Company. Due to his remarkable investment savvy he has retired at a young age and now spends his time investing and teaching others how to achieve financial security.

Christopher Meza is a nationally recognized speaker and Land Banker. He was chosen as one of the world’s leading experts in land investing to keynote the “Success In The New Economy” conference with Steve Forbes, Chairman and Editor-in-Chief of Forbes Magazine.

Christopher is also a co-author of the Best-Selling book “SuccessOnomics” with Steve Forbes. Christopher Meza has also been interviewed on the Brian Tracy Show hosted by the legendary Brian Tracy. Christopher’s feature interview can be seen on ABC, NBC, CBS, and FOX affiliates across the country.

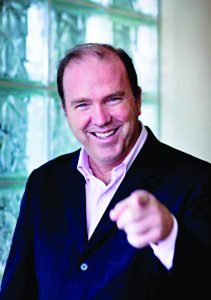

Meet and Learn from America’s Small Business Expert®

Are you ready to elevate your brokerage, deal flow, business and life?

Are you ready to elevate your brokerage, deal flow, business and life?

Bill Walsh a venture capitalist and is the CEO/Founder of the Success Education/Business Coaching firm Powerteam International. Bill hosts and speaks at events all over the world! His passion is to empower entrepreneurs and business owners to create massive success. He is the best selling author of the book “The Obvious”, is an amazing speaker, radio personality and movie celebrity.

Bill Walsh a venture capitalist and is the CEO/Founder of the Success Education/Business Coaching firm Powerteam International. Bill hosts and speaks at events all over the world! His passion is to empower entrepreneurs and business owners to create massive success. He is the best selling author of the book “The Obvious”, is an amazing speaker, radio personality and movie celebrity.

He has a very successful background in finance and marketing. He has spent over two decades working with start-ups to major global brands to help them increase sales, productivity and overall success. He is an innovator with a remarkable ability to determine and build success plans to help business owners seize immediate market opportunities.

For everyone that owns a business or would like to capitalize their entrepreneurial dream, his message will enlighten them with knowledge and action principles to turn that passion into success! Bill has an extensive background in foreign currency trading, real estate development and building businesses in more than 30 countries. Over the past two decades, his firm has specialized in helping companies launch, grow and create exponential valuation in the market.

In 2005, he formed his own company, Powerteam International to spread his message to a wider audience. Powerteam International provides Success Education programs around the world. The programs are designed for individuals, companies, and organizations that are interested in creating even more success. Bill is committed to raising the awareness of entrepreneurs, business owners and organizations world wide!

FIND YOUR NEXT FIX AND FLIP LENDER RIGHT HERE

Discover Your Resources for the Funding Your Need with Phenomenal Companies, such as: The AV Fund Group, Business Capital Experts, and Zinc Financial – We have the resources for you to succeed.

Michael Lally – Business Owner, Wealth Advisor

Michael Lally – Business Owner, Wealth Advisor

Learn to generate High-Yield Real Estate Income without a Mortgage! Discover how monthly income (cash flow) without the maintenance of owning rental property can provide a peace of mind. These same strategies are utilized by many of the larger financial institutions.

Michael has spoken at the New York Stock Exchange at the Investment Executive Conference sponsored by Index Universe which is now ETF.com, the world’s leading authority on exchange-traded funds. Michael discussed strategies for increasing income on individual ETFs.

Prior to starting his own firm, Michael has educated hundreds of financial advisors about different income solutions and their respective risks for their clients while raising over $200 million for various companies. Michael has gained a unique perspective on tending to his clients individual needs and concerns – Michael resides in East Greenwich, RI with his wife and two children. Away from the business, Michael enjoys cooking, traveling and spending time with family and friends.

JUST ADDED: How To Play Big and Win Big With Luxury Million $ Vacation Homes

MEET THE FRIENDLY FLIPPER

One of Central California’s MOST ACTIVE investors!

Jeremy Rubin aka “The Friendly Flipper” is a real estate expert and central coast native.  He purchased his first investment property in 2011 and has been successfully flipping homes in California for the past 3 years.

He purchased his first investment property in 2011 and has been successfully flipping homes in California for the past 3 years.

In addition to running his investment business, Santa Maria Property Solutions, LLC he is also developing a virtual training program “Friendly Flipper Academy”, to teach others how to invest in real estate.

He will be joining us and talking about how to grow your RE business using social media and answering all your questions on flipping homes!

Justin Ford – BROKER IN TWO STATES + FOREX TRADER

Difference Maker, Champion, Entrepreneur, Leader, Visionary

From struggle to success, Justin Ford truly lives the saying “It’s not how to start but how you finish.” At the age of 19, with his life in disrepair, Justin made the critical decision to turn it all around. Now at the age of 34, Justin has become a successful Entrepreneur, Business Owner, Real Estate Broker, Investor, Motivational Speaker, TV talk show host, Author, and Mentor.

From struggle to success, Justin Ford truly lives the saying “It’s not how to start but how you finish.” At the age of 19, with his life in disrepair, Justin made the critical decision to turn it all around. Now at the age of 34, Justin has become a successful Entrepreneur, Business Owner, Real Estate Broker, Investor, Motivational Speaker, TV talk show host, Author, and Mentor.

He has earned numerous achievement awards, and demonstrates daily that talent, drive and ambition really do lead to success. Justin also excels as an inspirational youth and marketplace speaker. People can feel his powerful presence when he walks into the room.

He wants to make a difference, and he takes that responsibility extremely seriously. Justin’s passion and desire to see people rise to success leaves a lasting impact as he challenges all to become the champion they were created to be.

Justin lives in Metro Detroit with his wife and four children. The love and support of his family helps fuel his passion for success in all avenues that he pursues. In his spare time, Justin loves to travel and donate his time to The Positive Zone Project Foundation, which empowers high school students through character education and leadership development, while providing tools for building successful lives.

CHARLES SELLS, founder of The PIP Group – Discover Tax Liens

About Charles: Charles Sells is the founder of The PIP Group, a highly successful turn-key service provider that focus on investments in distressed real estate assets including tax liens, tax deeds, traditional foreclosures, fix/flips and long-term cash flow acquisitions.

About Charles: Charles Sells is the founder of The PIP Group, a highly successful turn-key service provider that focus on investments in distressed real estate assets including tax liens, tax deeds, traditional foreclosures, fix/flips and long-term cash flow acquisitions.

Through steady, calculated growth and conservative moves over the past 18 years, Charles has transformed The PIP Group from just $4,000, one man and four potential investors into one of the largest agencies of its kind with more than 700 investors worldwide.

About The PIP Group: The PIP Group provides push-button, turn-key servicing on behalf of investors who are interested in passively investing in tax liens, tax deeds, traditional foreclosures, fix and flips and long-term cash-glow acquisitions. Internationally recognized as a leader in our industry, The PIP Group is the only agency of its kind that offers its clients extraordinary return on their investments while allowing them to retain 100% of control and ownership.

CEO OF THE AVFUND GROUP

CEO OF THE AVFUND GROUP

RAUL AVILA

Learn How The AVFund Group Can Help You CLOSE MORE DEALS

The Avfund Group is the premier Company for real estate investors/ flippers in California.

With over 35 years of extensive experience, The Avfund Group can assist you in funding your acquisitions. Whether it’s just remodeling and upgrading or adding square footage to the existing structure we can fund 100 % of the construction costs.

Avfund’s Fix & Flip loan programs assists you in the acquisition of distressed properties consisting of SFR and up to 4 units. It is our goal to assist you in leveraging your capital in order to acquire more properties. While most lenders only lend from 60 to 65% of the “after repair value” (ARV) of the property, Avfund will lend up to 75 % of the ARV.

Avfund prides itself in being more than a very competitive lender; we assist our investors in acquiring, purchasing, fixing and the resale of their properties. Avfund also can assist in other private lending for equity loans, bridge loans and new construction.

Meet Local REI Leaders and Club Directors, Such as DAVID CHURCH from Orange County – MINGLE WITH LEADERS!

David Church graduated from Cal Poly Pomona in 1998. He purchased his first house in 2002, and flipped his first house in 2004 without seeing the property.

David started wholesaling and was happy as a wholesaler. In 2012, he bought a foreclosure in Pomona and did his first rehab.

In 2014 he was working with a homeowner in Paramount, Calif., who had his property foreclosed upon. This property sold at auction, and he had surplus funds.

This was the first time David had heard the term Surplus Funds.

He now teaches people how to go after properties with surplus funds – and the best part is you can get paid without putting any of your own money at risk. Discover this UNIQUE NICHE only HERE!!!

Do You Want to Learn from the #1 Home Buyer in AMERICA?

Do You Want to Learn from the #1 Home Buyer in AMERICA?

HERE IS YOUR CHANCE RIGHT NOW!!!!

Meet Mark McKeller and Jake Chase as they share how HomeVestors® has purchased over 80,000++ houses to become the #1 Home Buyer in America!!

HomeVestors is the “We Buy Ugly Houses” company. We have bought over 55,000 houses, making us America’s #1 Homebuyer. Mark McKeller has been buying houses with HomeVestors for the past 12 years. He and HomeVestors are experts on how to get calls and buy houses from motivated sellers that other investors can’t find.

We buy properties that are not listed and aren’t REO or foreclosures, so there’s much less competition. In addition to buying houses, Mark spends time coaching those new to HomeVestors on how to get the most deals out of their calls. Mark can tell you how to work with America’s #1 Homebuyer to buy more houses, and maybe get some of your own calls from the “hidden city of sellers” only HomeVestors knows how to find.

MEET YOUR PRIVATE MONEY MAN – MR. REED BLAKE, CEO OF BUSINESS CAPITAL EXPERTS, PLUS THE CAST AND CREW FROM PROPERTY PITCH – OUR FIRST TV PILOT.

GET THE FUNDS YOU NEED TO GROW YOUR REAL ESTATE OR BUSINESS TO THE NEXT LEVEL – DON’T MISS THIS!

Reed Blake is the founder of BUSINESS CAPITAL EXPERTS, the fastest growing small business funding company in its area of expertise. A former Vice President of a firm, who raised over $1 Billion in funding for its clients in 7 years, as well as an accomplished speaker, who has spoken to tens of thousands of people on business funding.

BCE specializes in Unsecured Business Lines of Credit and Unsecured Cash Loans (YES – we can do this for Real Estate Investors!). The BCE team has between 6 and 25 years of experience and the relationships needed to get our clients operating capital, traditional investment funding and to take our client’s companies public.

We can also fund your growth, portfolios and notes…real estate transactions from $25K to $22 Million – this includes residential, industrial and commercial transactions. You will find Mr Blake’s presentation not also enlightening, but also highly entertaining.

To RSVP and secure complimentary tickets, while they last, CLICK HERE

Learn About Flexible Lending Options for New Investors as Well As Seasoned Rehabbers!

JASMINE R. WILLOIS – MANAGING DIRECTOR OF THE NAP (NOTE ASSISTANCE PROGRAM)

Jasmine R. Willois has owned rentals and FLIPPED out-of-state properties since 2005. She is the investor relations manager for American Home Recovery Fund, the founder of The Note Assistance Program ©, Lady Landlords of San Diego, Lien Lords of Orange County© and an active Realtor in the state of CA.

Jasmine R. Willois has owned rentals and FLIPPED out-of-state properties since 2005. She is the investor relations manager for American Home Recovery Fund, the founder of The Note Assistance Program ©, Lady Landlords of San Diego, Lien Lords of Orange County© and an active Realtor in the state of CA.

Her companies provide additional security and education on real estate investing, specifically with non-performing notes and retail FLIPS.

Jasmine has been a licensed real estate agent in California since 2004 and continues to do traditional sales and short sales for a small group of clients. With a reputation for the judicious use of resources and result oriented management style her experience with short sales has opened many doors.

Combining executive leadership skills, rare team-building strengths and a strong foothold for financial services, Jasmine offers a unique blend of experience.

She received her B.A in Economics from California State University at Long Beach, and enthusiastically accepted her first job as an equity trader with Joseph Stevens, in New York, NY.

She emotionally ended her 7-year long career on Wall Street as financial advisor with Morgan Stanley Dean Witter after losing colleagues to the world trade center attacks. An advocate for responsible investing she spends her time educating her audience on conservative real estate cash flow strategies and the abundance of opportunities that lay out side of their backyards.

She offers free education for novice note investors at her Note Lunch & Learn hosted every Thursday from12 noon to 1pm at her Orange County office. Jasmine serves on the board of 2 non profits, Hope Ranch and the National Association of Black Professional Golfers; and proudly sponsors The All Star Golf Tour, Team Joyce and Bec Rawlings UFC fighter. Jasmine enjoys traveling in her spare time traveling and exposing her young ones to the many different cultures our county has on display. She has two cats, 2 dogs, 2 turtles, 16 horses 9 chickens and two children.

Gary Massari, Founder of Make Money Now Real Estate Investors

Gary Massari, Founder of Make Money Now Real Estate Investors

Leading REI Coach & Trainer

Gary Massari is best described as a man with a long and successful past! He is a top real estate investor and trainer who ran a successful peak-performance school and trained over 3000 realtors, investors and loan officers to become top income earners. He was also the managing partner of the largest mortgage brokerage company in northern California. Then there were his years as a co-host on the very popular radio show in the San Francisco Bay area where he taught financial literacy to over 25,000 weekly listeners.

Gary helps to build his students, followers, and team members their own unique master plan to achieve their REI Wealth.

He’s also a best-selling Amazon Author in four different categories, with more than 300 published works and the founder of Make Money Now Real Estate Investors. If there’s anybody in the know, it’s Gary. In fact, through Gary’s mentoring programs, he has had students become millionaires and build their own fortune 5000 companies.

But what makes Gary tick? Gary believes that a person’s success requires a few things: Hands on mentorship, community, education & local support. He has built an entire REI club and network around those concepts.

For Gary it’s about giving the full experience to the student so they can actually get out there and succeed. One of his single-most sought after programs is the “Ultimate Master Plan for Real Estate Investors”, which contains many parts that help one become a master of their own life and their own investments. His goal for you is to retire debt free, mortgage free and wealthy.

Gary breaks your master plan down into these critical areas:

- A Personal Budget

- Debt Retirement Including Mortgage Debt

- 5-Year Income Plan

- A Real Estate Purchasing Schedule for properties and notes

- A Net Worth Balance Sheet to measure their wealth as they grow it

One key service that Gary offers is his national REI Club where he provides to his membership all the key components of success that are so important to him: Hands on mentorship, community, education & local support. And his education is always exciting, thorough and top notch! Just look at some of these workshops:

- How to find hidden deals and beat your competition to the Bank

- How to build their net worth and a create a debt free mortgage free retirement

Come see him speak in Los Angeles and Palo Alto in July!

Learn with PROVEN Leaders in the Industry, Both Local and Out-of-State Professionals!

Since 2007, Realty411’s mission has been to provide the resources, information, insider trips and strategies that investors need to significantly expand their portfolios.

Realty411 Advantages:

- Learn the latest technology to help grow your business

- Meet other investors with common goals and processes

- Develop relationships with leaders in the industry

- Share new opportunities with potential clients

- Learn how to help & mentor new investors

Jason Kennedy – Going From Broke with a Master’s Degree to Making Money in Real Estate!

Jason Kennedy – Going From Broke with a Master’s Degree to Making Money in Real Estate!

After achieving a Master’s Degree in Counseling Psychology, Jason (“Jay K” to his friends) got laid off from his job. This made him realize that he needed to take control of his financial destiny, and he invested in a Real Estate Training Seminar to learn how to become a successful Real Estate Investor. That was 13 years ago, and he has never looked back. He not only invests full time, but has served as a trainer, mentor, and coach for aspiring real estate investors for over 10 years. He also added his license as a Realtor in California so he could provide more opportunities to help and mentor his clients to achieve success through Real Estate.

Jay K is also the founder and creator of the cutting edge training system, “3 Days to Real Estate Riches! Get a Deal in 3 Days!” This is the system that Jay K, as well as his students use to open up any market, build their real estate business in that market, and have deals in the pipeline in just 3 days!

Whether you’re a new investor looking to get started, or a seasoned vet looking to open up multiple markets, this system is for you. His specialties include wholesaling, fix and flips, buy and holds, and multifamily investing.

Justin Ford – Difference Maker, Champion, Entrepreneur, Leader, Visionary

Justin Ford – Difference Maker, Champion, Entrepreneur, Leader, Visionary

From struggle to success, Justin Ford truly lives the saying “It’s not how to start but how you finish.” At the age of 19, with his life in disrepair, Justin made the critical decision to turn it all around.

Now at the age of 34, Justin has become a successful Entrepreneur, Business Owner, Real Estate Broker, Investor, Motivational Speaker, TV talk show host, Author, and Mentor.

He has earned numerous achievement awards, and demonstrates daily that talent, drive and ambition really do lead to success. Justin also excels as an inspirational youth and marketplace speaker. People can feel his powerful presence when he walks into the room.

He wants to make a difference, and he takes that responsibility extremely seriously. Justin’s passion and desire to see people rise to success leaves a lasting impact as he challenges all to become the champion they were created to be.

Justin lives in Metro Detroit with his wife and four children. The love and support of his family helps fuel his passion for success in all avenues that he pursues. In his spare time, Justin loves to travel and donate his time to The Positive Zone Project Foundation, which empowers high school students through character education and leadership development, while providing tools for building successful lives.

- The issues associated with using property managers,

- How to find a good a good property manager- what to look for, and

- The difference between a manager who manages your property to cover cost as opposed to making a profit.

BE SURE TO DOWNLOAD GARY’S REPORT TODAY

Housing Trends & What They Mean to Investors

CALIFORNIA MARKET UPDATE WITH

GERALDINE BARRY

Local Realty Marketing Leader, Investor and REI Insider

Geraldine Barry emigrated to California from Ireland with only $500 in her pocket. Through her determination, planning, organizational skills, and sense of humor, she has created a life where she can do what makes her heart sing every day.

Geraldine Barry emigrated to California from Ireland with only $500 in her pocket. Through her determination, planning, organizational skills, and sense of humor, she has created a life where she can do what makes her heart sing every day.

Her philosophy of investing strategically in real estate has put two children through private school, gives her the freedom to live a life dedicated to making a positive change in the world, and has assured her secure retirement – and all this as a single parent.

Widely regarded as an “Icon in the Silicon Valley real estate investing world,” Geraldine provides investment counseling and personalized financial plans and investing opportunities to real estate investors, high net worth individuals, and real estate newbies alike.

Geraldine founded and previously served as president of the SJREI Association, Silicon Valley’s hub for investment inspiration, forging connections, and building a reputation for calling the markets and leading by example with her own portfolio of investments. She was publisher/founder of REI Voice magazine and in that position interviewed every major player on the real estate landscape from economists to industry thought leaders.

Geraldine attributes her success to a willingness to learn along with others, a steady supply of green tea, and the habit she learned from her father of being productive and beginning each day in the early hours of the morning. Geraldine lives in Silicon Valley, the entrepreneurial capital of the world and loves it, with her two children Colin and Claire.

Please note speaker schedule may change. For updated information, please call our office @ 805.693.1497

Please note speaker schedule may change. For updated information, please call our office @ 805.693.1497