Our featured speakers include HGTV’s newest design & real estate duo, twin sisters Alana and Lex LeBlanc (a.k.a. Listed Sisters), who help families move up the property ladder!

ALANA BARNETT & LEX LeBLANC

Identical twins Alana and Lex are the ultimate combination when it comes to real estate and home design. With realtor Alana’s endless knowledge of the housing market and designer Lex’s fearless creative style, these sisters are helping their clients renovate their homes into hot properties so they can sell them for a premium and move into their dream location. Alana and Lex are the stars of the upcoming HGTV show, Listed Sisters.

Lex is the founder of LAVA Home Design and Alana is a partner. In addition to learning LIVE AND DIRECTLY from these two HGTV celebrity rehabbers, the Lone Star Real Estate Expo in H-Town also features fantastic features from throughout Texas and from around the nation!

Learn from them as well as Gene Guarino, Steve Rozenberg, Justin Ford, Patrick James, Todd Dotson, Daniel Chad Moore, John Jackson, Juan Carlos Cruz,Cliff Gager, and so many more outstanding companies and people from Texas and around the nation!

Don’t miss the opportunity to network and mingle with TOP INVESTORS from Texas and guests visiting from California, Arizona, Arkansas, Florida and more.

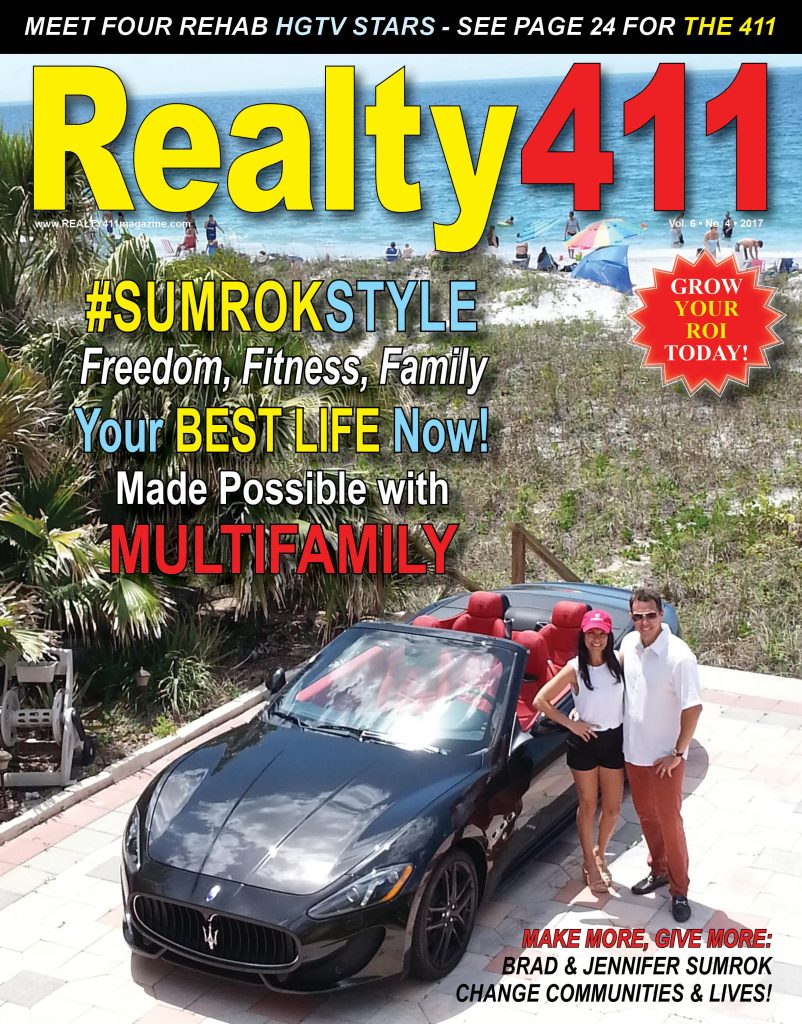

REALTY411, the longest-running real estate investor media and expo company owned by the same California owner/agent, is celebrating a brand new issue and a 10-year anniversary.

A new year and new administration is upon us and savvy investors want to forecast what’s in store for them in 2017, and the next four to eight years.

Our event in Houston, Texas is scheduled for September 9, 2017- Our last event united notable speakers, such as Dennis Henson, Dolf de Roos, Merrill Chandler, Phil and Shenoah Grove, and many others!

Our Houston Expo Host is Edwin Kelly, from Specialized IRA Services

Edwin Kelly is CEO of Specialized IRA Services and is considered America’s leading expert on Self-Directed IRA’s. He has more than 24 years of experience in the Financial Services Industry. He worked for such notable companies like UBS and BISYS. Edwin is a Founder and currently serves as CEO of Specialized IRA Services.

Producing this community and family-friendly FREE expo is REALTY411, (http://realty411expo.com) the longest-running media and marketing company in the real estate investor space. Since 2007, REALTY411 has been positively impacting the REI industry by sharing important real estate knowledge through their publications, national expos, podcasts, and webinars.

Additionally, this all day expo, which will be promoted in local media, as well as to national investors, will attract guests and company sponsors from around the country, including: Florida, Arizona, Texas, Arkansas, Nevada, Georgia and more. Expo guests will enjoy multiple breakout sessions so they can choose which topic they wish to learn about. The ballroom has been reserved for this fantastic networking expo and mixer, and complimentary coffee and pastries will be served to early-bird guests.

REALTY411 (http://realty411Magazine.com) is celebrating its brand new publication, as well as an anniversary of three years in producing their digital issue, REI WEALTH (http://reiwealthmag.com), a monthly interactive publication. As one of the most prolific publishers in the real estate investment industry, REALTY411 has dozens of events on schedule for 2017, as part of their national tour to celebrate a decade in business.

To reserve your complimentary ticket to this wonderful event to celebrate REALTY411, please call: 805.693.1497 – Sponsorship & speaking opportunities are available, let us exponentially grow your business!

HERE IS ADDITIONAL INFORMATION ABOUT THIS EVENT.

Don’t Miss Our Second Expo and Conference in Houston, Texas!

Our Lone Star Real Estate Investor’s Expo does it again, but this time we are bringing the STARS of HGTV with us. This is your chance to get up-close and personal with

This year, our featured speakers include HGTV’s newest design & real estate duo, twin sisters Alana and Lex LeBlanc (a.k.a. the Listed Sisters), who help families move up the property ladder.

Learn from them as well as Gene Guarino, Steve Rozenberg, Justin Ford, Todd Dotson, Daniel Chad Moore, John Jackson, Cliff Gager, and so many more outstanding companies and people from Texas and around the nation!

Don’t miss the opportunity to network and mingle with TOP INVESTORS from Texas and guests visiting from California, Arizona, Arkansas, Florida and more.

REALTY411, the longest-running real estate investor media and expo company owned by the same California owner/agent, is celebrating a brand new issue and a 10-year anniversary.

A new year and new administration is upon us and savvy investors want to forecast what’s in store for them in 2017, and the next four to eight years.

Our last event in Houston united notable speakers, such as Dennis Henson, Dolf de Roos, Merrill Chandler, Phil and Shenoah Grove, and many others!

LEARN FROM AMAZING EDUCATORS AND INVESTORS HERE!

GENE GUARINO – RESIDENTIAL ASSISTED LIVING ACADEMY™

Residential Assisted Living Academy™ is a America’s #1 source for senior care home investment and business education. Headed by leading national expert, Gene Guarino, RAL™ Academy has trained thousands of people throughout the United States how to… “do good and do well”.

Their mission is to empower investors and entrepreneurs by training them to do business with excellence and be well rewarded by doing so.

“We train our student associates to build a quality business that will provide for their family a professional income that can last a lifetime and beyond.” -Gene Guarino

☑Achieve a Level of Security That Affords You the Lifestyle You Desire

☑Create an Executive Level Cash Flow and Make a Positive Difference

☑Gain Access to the Next Significant Wave of Real Estate Investing Opportunity

…They Can Help YOU.

With 77,000,000 baby boomers, there is an unstoppable “silver tsunami” of opportunity in senior housing. How do I know that… because after 30+ years of investing, being in business and traveling the world training people how to financially succeed… all I’m focused on is residential assisted living care homes for seniors. Why…because the opportunity is tremendous and the cash flow is VERY, VERY generous.

►10,000 People a Day Are Turning 65

►4,000 a Day Are Turning 85

►70% Will Need Special Accommodations for an Average of 3 ½ Years

Many seniors will need to live somewhere other than in their own home or apartment. Today, they are currently paying me $3000-$6,000 a month for housing and related support services. This could be you!

According to Forbes, the average investor has gained only a 2.6% net annualized rate of return for the last 10 year period and hasn’t fared any better over longer time frames. The 20 year comes in at 2.5% and 30 years is just 1.9%. Those who ventured into the real estate market have seen up & down times. Some tried flipping properties for excellent profits, but chasing equity deals has become much more difficult.

PLUS, LEARN ABOUT PROPELIO with the CEO!

Daniel Moore’s Bio:

In 2008, at the age of 23, Daniel Moore bought his very first investment property. Since then, he has learned his lessons very carefully, so that, by the age of 28, he became a full time investor, and was inducted into Robert Kiyosaki’s Rich Dad Hall of Fame. He completed more than 60 properties last year alone – ranging from wholesales, rehabs, sub2s, wraps, short sales, mobile homes, and a million-dollar new construction. From this varied experience, Daniel has accumulated extensive first-hand, real world knowledge on the “how-to’s” of real estate investing.

Daniel teamed up in 2014 with Nate Worcester, in order to create a software service company that would meet the operational needs of serious real estate investors. They spent two years designing and testing a unique online platform. Today, “Propelio.com” is the result of their combined efforts – delivering access to real time comps, reducing waiting time to make offers on discounted properties, to improve lead flow of motivated sellers, to keep the phone ringing, and provide a deal management system to help investors stay organized.

Houston Property Management by Empire Industries “Frustration Free Property Management By Investors For Investors”

Empire Industries, a National Award Winning Company, is a full service professional property management company servicing the greater Houston area. Whether your property is located in Spring, Katy, Houston Heights, Kingwood or even Texas City, Empire Industries Property Management has got you covered.

Empire Industries provides marketing, tenant screening, leasing, make ready service, maintenance and accounting services. With Empire Industries Property Management as your partner, your business truly becomes “frustration free”!

Empire Industries Property Management is an award winning management company. Empire was a top five semi-finalist for a National Business Excellence Award for Marketing and Customer Service. We also hold the Certified Property Management (CPM) Designation from IREM, are members of the Houston Area of Realtors (HAR) and have served on the board of directors for the National Association of Residential Property Managers (NARPM).

We are investors just like you! We not only manage properties, but we own a number of properties. We have been investing in Houston real estate since 2001. If you are an investor looking for properties we are a great resource, as we have contacts with different investor groups and wholesalers.

SAVE TAXES – LEARN FROM THE AUTHORITY, MR. PATRICK JAMES

I am proud to announce our main speaker for this month, Patrick James, who is speaking on the behalf of Scott Estile. Patrick was the speaker who a number of years ago lead me to my Tax Preparer Scott Estile. Scott wrote the book Tax This. I am very happy with Scott Estile and know that Patrick is a great speaker with a lot of very important Tax information through his own company that will be of great benefit for all of us.

Patrick James, president and CEO of United States Tax Releif, LLC. He has dedicated his entire career to helping people create and preserve wealth through knowledge. His marketing expertise was instrumental in launching a tax reduction program with Scott Estill, a former senior trial attorney for the IRS and Anderson Advisors. Together, they created a tax team to teach people how to take advantage of every possible tax deduction in order to minimize tax liabilities and maximize tax deductions. Patrick is a graduate of the University of Portland. In 1997, he became president of a national speaking firm, which specialized in financial education. Patrick has spoken at conferences with Donald Trump, Alan Greenspan, Magic Johnson, Colin Powell and many others. He been a guest on more than 100 radio and television talk shows and has been featured in Newsweek and It’sYour Money (a New York Times best-seller). He was also the recipient of the BusinessMan of the Year 2002.

Patrick James will cover some of the follow below.

* How to become 100% AUDIT PROOF!! 99 Ways to beat the IRS with a 3-Year Review Receive THOUSANDS OF DOLLARS back from the IRS that you accidentally donated over the past 3 years

* How to Track Your Expenses & Mileage Start giving your Tax Preparer the CORRECT information – This means more tax deductions and more $$ in your pocket!

* Learn how to Categorize your expenses the RIGHT way! Save 50% (or more) on your taxes EVERY year – FOREVER

* It’s your money, not the IRS – Only pay what you legally owe and not one penny more!

Hosting this community and family-friendly FREE expo is REALTY411, (http://realty411expo.com) the longest-running media and marketing company in the real estate investor space. Since 2007, REALTY411 has been positively impacting the REI industry by sharing important real estate knowledge through their publications, national expos, podcasts, and webinars.

Additionally, this all day expo, which will be promoted in local media, as well as to national investors, will attract guests and company sponsors from around the country, including: Florida, Arizona, Texas, Arkansas, Nevada, Georgia and more. Expo guests will enjoy multiple breakout sessions so they can choose which topic they wish to learn about. The ballroom has been reserved for this fantastic networking expo and mixer, and complimentary coffee and pastries will be served to early-bird guests.

REALTY411 (http://realty411Magazine.com) is celebrating its brand new publication, as well as an anniversary of three years in producing their digital issue, REI WEALTH (http://reiwealthmag.com), a monthly interactive publication. As one of the most prolific publishers in the real estate investment industry, REALTY411 has dozens of events on schedule for 2017, as part of their national tour to celebrate a decade in business.

Our Houston Expo Host is Edwin Kelly, from Specialized IRA Services

Edwin Kelly is CEO of Specialized IRA Services and is considered America’s leading expert on Self-Directed IRA’s. He has more than 24 years of experience in the Financial Services Industry. He worked for such notable companies like UBS and BISYS. Edwin is a Founder and currently serves as CEO of Specialized IRA Services.

During his career, Edwin has also helped set up a Self Directed IRA provider and grow it from 2 employees with approximately 300 accounts to 15 employees with approximately 3000 accounts.

Edwin has helped one Self Directed IRA Custodian to become the largest in the industry. In 7 years, he grew the company from 97 employees to 300 employees, increased the Assets Under Custody from $2 Billion to $12 billion, and participated in the successful acquisition of 3 competitors.

Edwin is an avid educator, adding value to clientele by developing significant knowledge assets at every company he has worked with. His passion for helping others learn about their Self Directed IRA options has made Edwin a popular and engaging speaker who is frequently invited to speak at seminars and workshops, in webinars, and as a radio guest. Edwin has made several special appearances on the Money Show, and his work and ideas have been featured in major national magazines and newspapers throughout the United States.

Topics he is frequently asked to speak about include:

** What the average person can do to take charge of their finances so they can stop worrying about money and can look forward to a comfortable retirement

** Little-known investment strategies that have helped people retire sooner than they expected

Completely legal secrets to growing wealth tax-free

** Edwin Kelly is a member of RITA (The Retirement Trust Association), attended The Ohio State University and holds an MBA from Franklin University. He is the co-author of the bestselling book Leverage Your IRA. He is currently writing his next book, The Retirement Dilemma and 7 Specialized Strategies You Can Implement to Solve It.

To reserve your complimentary ticket to this wonderful event to celebrate REALTY411, please call: 805.693.1497 – Sponsorship & speaking opportunities are available, let us exponentially grow your business!