News

Northwest Real Estate Investor Expo – Review Our Agenda

Northwest Real Estate Investor Expo

Honoring REAPS (Real Estate Association of Puget Sound)

9 am – Welcome & Meet Our Sponsors

9:15 am – 10:05 am – Matt Laurent, RealtyMogul.com

Borrowing From the Crowd: Accessing New Sources of Capital

Ask Questions | Network | Mingle with Vendors

10:10 am – 11:30 am – Curt Davis & Craig Jennings, BuyMemphisNow.com

Learn How Two Investors from Tennessee Built their Portfolio

11:35 am – 12:30 pm – Jim Beam, LifeWay Advisors

Increase the ROI on Your REI – Learn this Innovative Strategy!

LUNCH BREAK, PLEASE STAY AT THE HOTEL

1:15 am – 2:45 pm – Reggie Brooks – Joining Us from California

Rags to Riches with Abandoned Properties with a Master Investor

Ask Questions | Network | Mingle with Vendors

3:00 pm – 4:00 pm – Kevin Rollings, Self Storage Investor Academy

CashFlow without Tenants, Toilets or Termites with Self Storage

Thank You to Our Sponsors

REAPS

(Real Estate Association of Puget Sound)

RealtyMogul.com

Buy Memphis Now

Security National Mortgage

– Bighuas/Chapman

Lifeway Advisors

Builders Capital

Seattle Investment Club

Fortune Foreclosures, LLC

Self Storage Investor Academy

The Reggie Brooks Group

New Harvest Ventures

Real Estate Investing: How to Make 3 Times More Returns Than Your Friends!

Turnkey rentals are great. They provide automatic passive income and all the perks of direct investment in property.

But is that the best you can do in returns and getting ahead?

Real estate is the investment for intelligent investors today. But where do you find the time and great returns without sacrificing everything else you love doing?

The Status Quo & Investment Strategies that Fit

There appears to be nothing safer to invest in than real estate today. The returns are pretty attractive too. But when sophisticated investors and busy professionals look at how most others are investing, it can start to appear challenging.

If you are a doctor, lawyer, professor, or even successful artist – you don’t want to ditch a great career you are passionate about to start from scratch learning about being a landlord.

Now hands-on fixing and flipping houses and managing your own rental properties can be great for those who don’t really love their jobs, or need a new source of income. But it’s a different story if you are already putting in 40 hours a week in something you like. Or if you are already financially independent and don’t want to cramp your free lifestyle.

If this is you, your friends might be invested in REITs, real estate company stocks or even turnkey rental property programs. These can be great ways to diversify a portfolio. But stocks and REITs are really too volatile.

Turnkey rentals are great. They provide automatic passive income and all the perks of direct investment in property. But is that the best you can do in returns and getting ahead?

You Can’t Afford Not to Demand More

The problem is that the vast majority of individuals and couples are way behind on retirement savings and wealth building. The average 401(k) balance is only around $100,000. Recent data from the Federal Reserve shows that retirement savings and investment balances drop to almost half by the time individuals are in retirement.

That means retirees are burning through half of their retirement funds within a year or two of exiting the workforce. Data 360 reports the average life expectancy in the United States is now just shy of 80 years old, and rising.

The bottom line is that whether you have double the average savings or even eight times your salary saved today – it just isn’t going to be enough. Not by a long shot. So how do you get ahead?

The Returns of Flipping Houses with the Ease of Passive Income

Remote Rehabs is re-opening its turnkey fix and flip investment program in Phoenix, Ariz. After being one of the first to kick-start the U.S. housing recovery, Phoenix is now set to lead in the second stage of growth with new jobs and rising property values.

Check out what’s happening in Phoenix, Arizona at: www.RemoteRehabs.com

The Remote Rehabs™ program offers a 100% hands-free, high-return way, to generate passive income in America’s hottest property markets. This service handles everything from sourcing properties, to acquisition, rehabbing and reselling for you.

It’s ideal for those investors who lack time, lack experience, and need to earn more than what they’re currently earning. It brings together all the best of the ease of passive income investing with high returns and faster profits of flipping houses. It’s the aggressive way to generate cash, faster.

So how do the returns stack up?

Imagine: Instead of investing in buying a single rental property that throws off $15,000 a year in positive cashflow you used Remote Rehabs to flip houses for you. It conservatively takes an average of 90 days to fix and flip a house.

So if you bought and sold just four houses per year and made $15,000 each time, you’d be way ahead. You’d be pocketing $60,000 per year. While your friends are just getting $15,000 per year on buy-and- hold properties.

What would an extra $60,000 per year do for your lifestyle or retirement savings?

The Real Estate Cash Machine

This system effectively gives real estate investors an automatic cash machine. Real estate education is good, rentals are good, and hands on rehabbing is rewarding. But if you want to diversify, really kick finances into high gear, get ahead, and don’t want to have to sweat or take the time out, check out Remote Rehabs.

Then, once you have this real estate cash machine working for you, you can roll over some of that money to buy-and-hold properties for long-term wealth building, or any other investment you are willing to take a shot at.

Article by Sensei:

Founder of Black Belt Investors, Sensei Gilliland has been featured on the cover of Real Estate Wealth Magazine, hosts ‘The West’s Top Ranked Real Estate Investors’ Club’ – 12 ROUNDS, and has engineered several highly popular trademarked real estate investment systems. Sensei is the go-to source for serious investors and entrepreneurs seeking extremely effective, no holds barred training, investment properties and funding. Claim your copy of his powerful Cash and Wealth by visiting: www.BlackBeltInvestors.com

It’s Time to Self Direct Your Future

By Tim Houghten, staff writer

Self-directed individual retirement accounts or IRAs are rapidly growing in popularity, but experts warn that it is important to only get into such an investment with proper education and professional guidance.

Kaaren Hall, owner of uDirect IRA Services in Orange County, California, says even after more than two decades in the financial industry and six years of running her company, she too must continually stay on top of her investment education, particularly regarding Internal Revenue Service guidelines for retirement accounts.

Self-directed IRAs allow people to invest their retirement funds into a variety of options outside of the traditional stock market, including real estate, land, and private notes.

“Financial literacy is not taught in schools, but our future depends on understanding it,” Hall says. “Only about 4 percent of U.S. investors have a self-directed IRA. Why?” Because most investors and many advisors simply aren’t aware of it. But even those who are aware of the potential financial power of self-directed IRAs often do not fully comprehend the IRS guidelines of “prohibited transactions,” according to Hall.

“You’re not allowed to have any personal benefit from your IRA prior to retirement,” Hall says.

A common misconception among investors is that they can use the self-directed IRA funds to purchase real estate or other property from themselves or close relatives such as a spouse, a child, a grandchild, a parent, a grandparent and any spouses of such relatives. These transactions are not permitted under self-directed IRAs, according to Hall. However, an investor could purchase property from a more distant relative such as a sibling, a cousin, a niece, or an uncle.

“Make sure you know what you’re doing,” Hall says. “We’re here to help people so they understand the twists and turns as much as possible. I’ve educated tens of thousands of people about the use of self-directed IRAs and uDirect IRA Services is set up to serve and educate self-directed IRA investors.”

The term self-directed in itself misleads some people because it is the IRA doing the investing, Hall adds. “So that’s confusing because they get into trouble by maybe signing a purchase contract (in their own name),” she says. “Your IRA can’t buy an asset that you own.”

Consequently, people should wait until they actually open an account with a qualified custodian before funding it and making transactions, Hall says. Generally, a custodian rather than the actual investor should sign purchase contracts relevant to self-directed IRAs.

While representatives of companies such as uDirect IRA do not give actual investment advice due to potential legal liability, they can help people follow ever-changing IRS guidelines.

Hall, a former mortgage broker whose work history includes Bank of American and Indymac Bank, has educated tens of thousands of investors into deciding whether self-directed IRAs are right for them. She and her associates have directly worked with thousands of clients.

To learn more about self-directed IRAs, call 866-447-6598 or visit: www.uDirectIRA.com

Nearly 1,000 Guests Registered for Realty411's Upcoming National Expos Around the Country.

Nearly 1,000 guests have registered for Realty411 Expos across the nation. The expositions, which have already reached nearly 900 people in 2015, elevates Realty411 Magazine as a leading publication that reaches their readers in person.

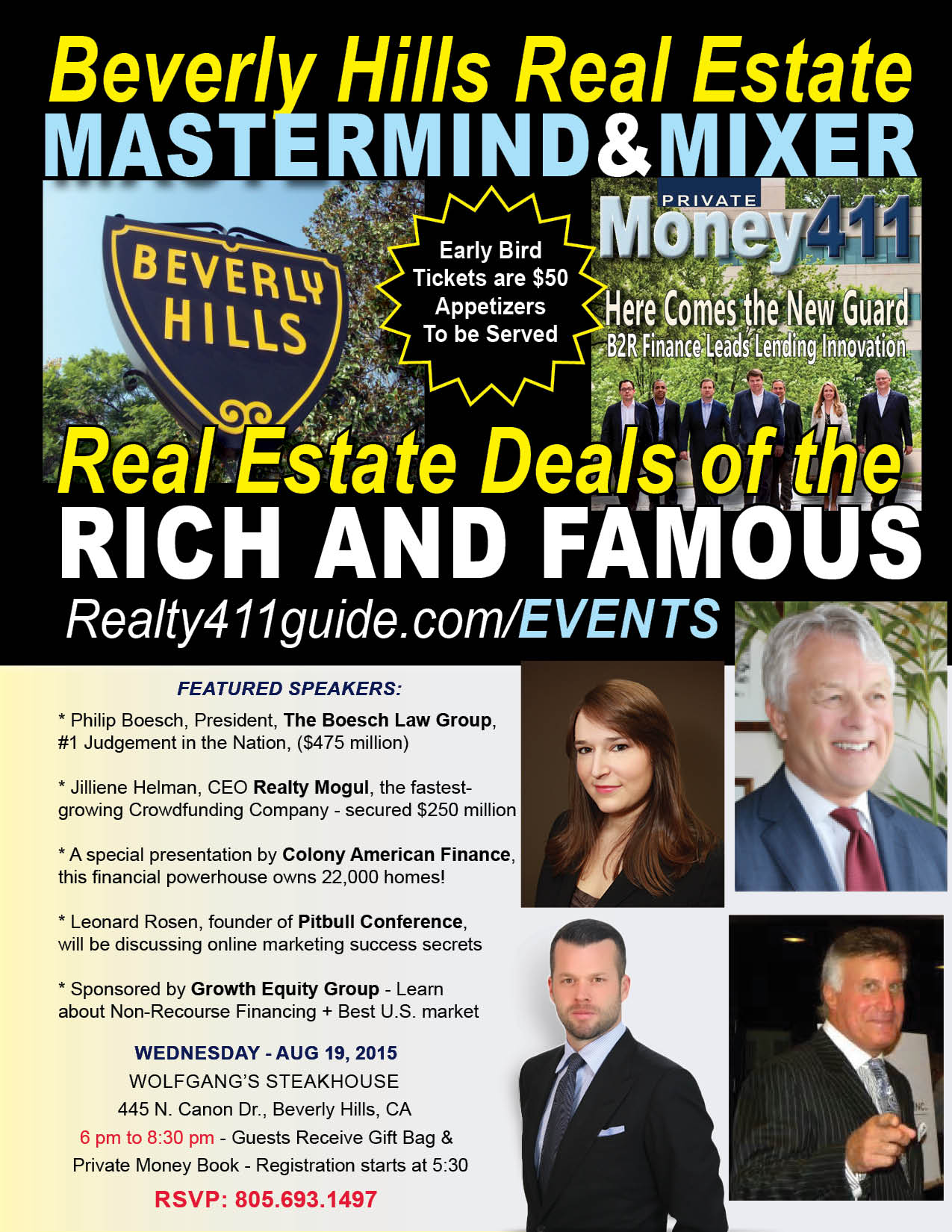

The company started the year off in January by hosting a VIP mixer mastermind in Beverly Hills, Calif. One of their most popular events was their popular Orange Country Real Estate Investor Finance and Tech Expo in Newport Beach, which thus far had the most attendees with approximately 400 guests.

“It’s exciting to meet our readers, fans and social media followers in person,” says Linda Pliagas, founder of Realty411. “I’ve had the opportunity to visit phenomenal cities and speak with investors in person to find out what their needs and questions may be.”

Realty411 Expos (https://realty411guide.com) have hosted events in spectacular cities, such as: Manhattan, NY; Phoenix, Ariz.; Seattle, WA; Las Vegas, NV; San Jose, Calif., and more.

Some of the topics that have been discussed at the complimentary expos, include: crowdfunding, wholesaling, private finance, fix and flip investing, buy and hold strategies, local real estate, out of state investing, credit optimization, insurance protection, notes, tax liens, asset protection, taxes, and more.

The community events are sponsored by leading companies and educators, and often times, the expos have also doubled as fundraisers for non-profit organizations, such as The Los Angeles Rescue Mission, the San Deigo Rescue Mission, NARF – Nike Animal Rescue Foundation, the Women’s Transitional Living Center in Orange County, among others.

Realty411 will produce a whopping 15 events in 2015, more than any other media and marketing company in the REI industry, which is helping them reach their goal of reaching nearly 2,000 people this year.

Although the company hosts the most events in the industry, the publisher’s 22-year media expertise, plus their marketing skills and creative business philosophy has allowed them to do more with less staff and overhead, which equates to more reasonable pricing for their clients.

Pliagas currently oversees a small office in Santa Barbara County, as well as a virtual staff of freelancers scattered around the country. The company has also employed freelancers abroad, allowing them the flexibility to hire as needed and save thousands of dollars over the years.

Because of the number of events produced, Pliagas is frequently contacted by real estate group directors, leaders and industry companies about their own events and receives requests to co-produce real estate expos around the world. She has also consulted with other expo companies and given them advice on how to successfully market their own events. Realty411 also frequently works with REIA clubs for their events so that guests can keep learning and growing with local resources.

For the rest of the year, Realty411 is working with other real estate club directors to produce joint events in Napa Valley, Calif., (BAWB); Manthattan, NYC (REIA NYC); and Arlington, Tex. (AREA).

Although Realty411 has been conservative in its approach to business operations, the company foresees a drastic jump in the number of events produced in 2016 and is currently preparing for such by seeking out larger office space to accommodate additional staff. The company is also diversifying their advertising and sponsorship-based business by adding new divisions, which compliment their existing media and marketing company while providing additional real estate-related services.

For information about Realty411 Magazine’s Expos, visit:

http://Realty411guide.com/EVENTS

or call: 805.693.1497

or our 24/hour info line: 310.499.9545

________________________________________________________

STOP EVERYTHING & RSVP TODAY!!!

Don’t miss Realty411’s Los Angeles Real Estate Investors’ Expo on Saturday, Sept. 19th at the Embassy Suites near LAX. With over 400 people already registered, this complimentary expo will stand out as the largest real estate expo in Los Angeles County this year.

Join real estate investors, realty professionals, and entrepreneurs who are truly Passionate about Real Estate. Speakers/Sponsors include: B2R Finance, LifeWay Advisors, Black Belt Investors, Realty Mogul, Credit Sense, Growth Equity Group, Robert Hall & Associates, Real Wealth Network, ALF Training Academy, Homevestors, U.S. Tax Relief, Reggie Brooks, Zinc Financial, Prosperity Through Real Estate, The Funding Warehouse, uDirect IRA Services, Synergy Financial Partners, SocialZing, and more!!

All guests will receive copies of Our Print Publications! Be sure to mark your calendar to join us to Celebrate 2 years of our online magazine, REI Wealth Monthly! You will not want to miss this expo reaching hundreds of people.

For information about Realty411 Magazine’s Expos, please visit:

http://Realty411guide.com/EVENTS

or call: 805.693.1497

or our 24/hour info line: 310.499.9545