Hard Money eBook – FREE DOWNLOAD.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Realty411 Radio: Norada Real Estate Investments

Hundreds of Investors From 8 States Unite in Las Vegas this Weekend!

411 PRESS WIRE – FOR IMMEDIATE RELEASE

FIRST TIME EVENT: Realty 411’s Free Las Vegas Real Estate Expo – THIS WEEKEND!

Join hundreds of real estate investors, private lenders, real estate professionals and entrepreneurs to celebrate Realty411’s brand new issue in Las Vegas, “the city that never sleeps.”

Guests will benefit from top-notch education throughout the day. Top industry leaders will join in from all across the country, including California, Arizona, Texas, Virginia, Tennessee, Florida, South Carolina and Georgia.

For more details visit: http://lasvegasrealestateexpo.eventbrite.com

This fabulous weekend will enable guests to make valuable connections, which could “skyrocket” their business and life, as countless Realty411 Expo attendees have found in the past.

Come mingle and network at Realty411’s Free Las Vegas Real Estate Expo at the Hampton Inn Tropicana

(4975 Dean Martin Dr.) this weekend (Oct. 4th & 5th) from 9-5.

Don’t hesitate to bring all of your friends, colleagues and associates along as general admission is free and open to the public.

If you can’t make it to Las Vegas this weekend, Realty411 is also hosting events in Long Island, NY on Oct. 25th (the Halloween Expo, “Don’t Have A Scary Retirement”), and in Los Angeles on Nov. 15th (the “Give Thanks, Give Back” Expo) to benefit the Los Angeles Mission.

Following is the links to our events, as well as the Las Vegas Schedule for Both Days:

Las Vegas:

http://lasvegasrealestateexpo.eventbrite.com

Long Island, New York:

http://longislandexpo.eventbrite.com/

West Los Angeles:

http://givethanksgiveback.eventbrite.com

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

THANK YOU TO OUR SPONSORS:

Inspired Capital Group

Rent to Reward

Epic Real Estate

Black Belt Investors

Accuplan Benefits Services

CreditSense

UDirect IRA Services

Santa Barbara REIA

Jason Burke – Las Vegas REI

Brad Sumrok – Multifamily Riches

John Gifford – HOA Receivables

Will “Power” Duquette

CashFlow Express

Real Estate Agents: Organize and Automate Your Taxes

We’ve all heard the saying, “There are only two things that are certain in life: death and taxes!” Some consider them equally unpleasant. Many agents get an overwhelming feeling just thinking about taxes. However tax time doesn’t have to mean stress time.

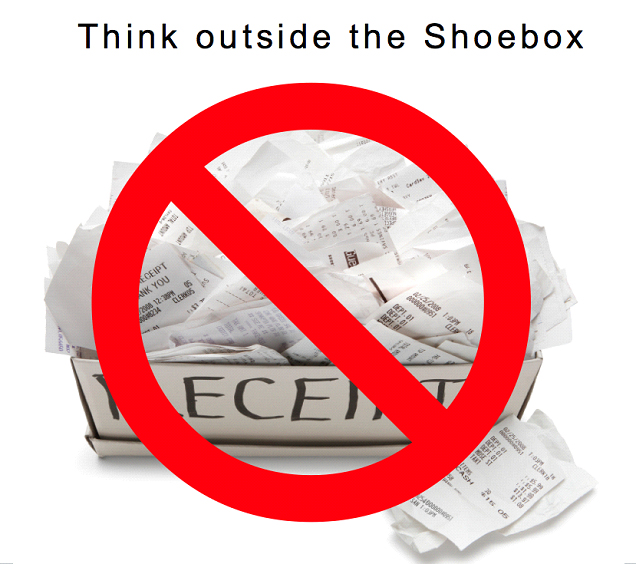

Deductr was designed to help real estate professionals maximize their eligible tax deductions and eliminate tax-time stress. Deductr’s web-based and mobile applications take the guesswork out of the tax equation by automating the tasks of tracking expenses, mileage, and time.  Tracking Expenses: As independent contractors, some agents understand that they need to track expenses, however too often their tracking system is a shoebox of receipts. That’s a sure-fire way to miss deductions. With Deductr, when the agent pays for any business-related expense with their credit card, debit card, or even by check (such as meals, office supplies, etc.)

Tracking Expenses: As independent contractors, some agents understand that they need to track expenses, however too often their tracking system is a shoebox of receipts. That’s a sure-fire way to miss deductions. With Deductr, when the agent pays for any business-related expense with their credit card, debit card, or even by check (such as meals, office supplies, etc.)

Deductr will automatically capture the information the IRS requires to get credit for that deduction. The agent simply confirms the business expense by clicking on the appropriate category. If the agent pays with cash, they capture a photo of the receipt with Deductr’s mobile app. It’s that simple! Tracking Mileage: Most agents are told to write down odometer readings for every business drive so that they can take advantage of the $0.56/mile business deduction, but few actually do.

With Deductr, as agents drive to a listing appointment, they click a button on their iPhone or android and Deductr taps into the GPS functionality in the smart phone to track and give credit for that mileage event. It’s that easy!

Tracking Time: Deductr not only makes it easy for users to track their time, but it also allows them to view their time, expenses and mileage in a whole new way. Because Deductr automatically imports credit card expense tracking information, Deductr places those transactions on the calendar, and does the same thing for mileage segments tracked with Deductr.

Agents simply Drag and Drop expenses and mileage onto calendar events such as showings or meals so that they are permanently associated together.

Finally, when tax time rolls around, Deductr gives the agent single-click access to everything they need to maximize all of the deductions they’re eligible for and keep more of the money they work so hard to make. Agents don’t get into real estate to become tax experts, so they need a system that let’s them focus what they do best – grow their business.

Deductr lets real estate professionals do just that. It’s time to “Think outside the shoebox”.

For more information visit www.deductr.com

Advanced Probate Training in San Leandro, Calif.

Please Review this Important Message from Our Sponsor

Don’t Miss Our Preview of this Event:

http://actvra.in/4n8Z

FREE E- Book on 5 Levels of Earning with Probate Homes

http://www.thediamondfarm.com/free-downloads.html

Registration for the Live 2 Day Oct 4th and 5th Probate R/E Academy

and or Live Streaming of Event